Is Cares Act Money Taxable

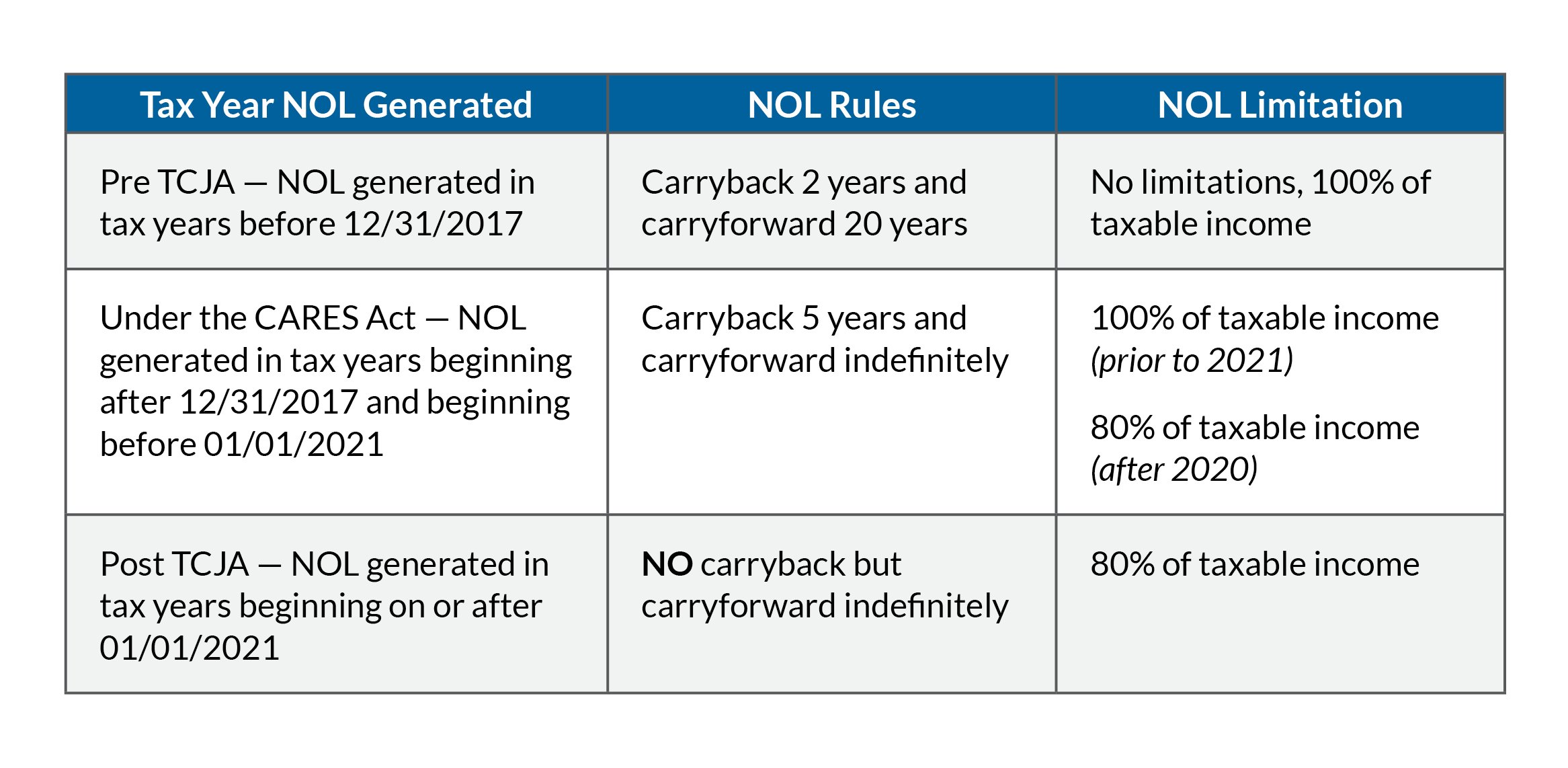

Sections 3504 18004 and 18008 of the Coronavirus Aid Relief and Economic Security Act CARES Act enacted on March 27 2020 allow higher education institutions to use certain funds allocated by the Department of Education to support students and higher education institutions with expenses and financial needs related to the coronavirus COVID-19 pandemic. Modifications for net operating losses NOL Businesses will be able to use net operating losses from 2018 2019 and 2020 to reduce taxes that were paid for the previous five years.

Does The Irs Owe You Money Grant Thornton

Does The Irs Owe You Money Grant Thornton

Taxpayers who owe a debt to the IRS and are eligible for the stimulus check under the CARES Act are eligible to receive a payment.

Is cares act money taxable. Government grants are taxable income to the recipient unless the tax law makes an exception. For federal tax purposes a forgiven PPP loan is not taxable. The amount of any.

Is money I receive from the CARES Act taxable. 748 unanimously 960. This was not the intent of the PPP program when Congress passed the CARES Act.

Some of the money will be considered taxable income. First the 25000 that you returned to another retirement plan within 60 days should not be taxable to you because it would be considered a rollover said Daniel Cocco a partner with Beacon Wealth Partners in Nutley. On July 13 2020 the Department of HHS updated the FAQs for the CARES Act PRF to state payments that a provider receives from the CARES Act funds would be taxable income.

TAX PROVISIONS The CARES Act also included several tax provisions of assistant to farmers ranchers and agriculture employers. In the event your PPP loan is not forgiven its treated like a normal loan and its not considered taxable. Some of the money will be considered taxable income.

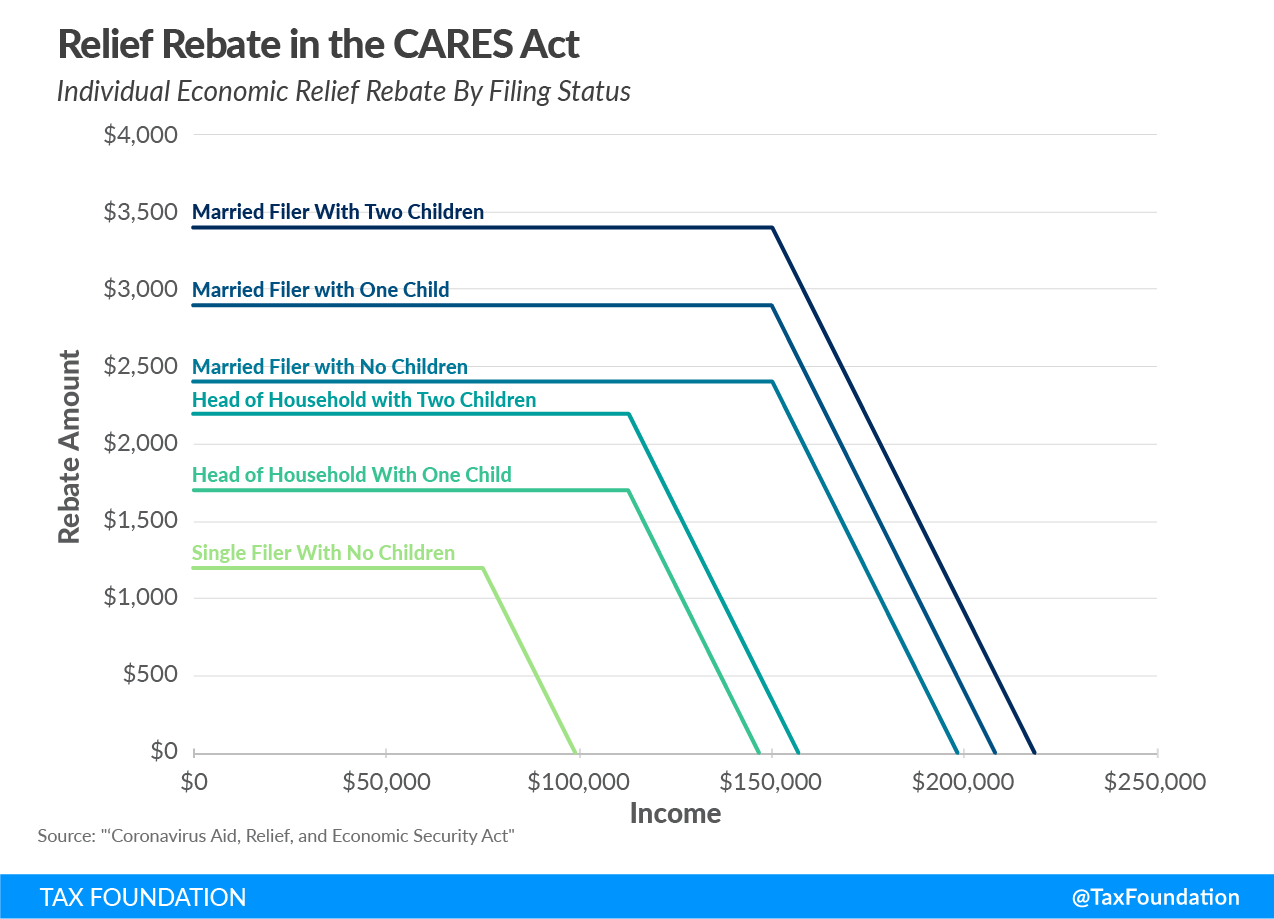

The structure of the rebate has generated some confusion so while my colleagues have developed an entire FAQ around this and other provisions of the CARES Act a quick explanation is in order here. It is anticipated that clarification regarding the deductibility will be issued by the SBA that will favor small businesses and grant the expenses deductible. The four Senators - not voting were self-quarantined due to confirmed or suspected exposure to the coronavirus.

COVID-19-related grants to individuals are tax-free under the general welfare exclusion. Senate on March 25 passed the CARES ActHR. Technically these rebates are a refundable tax credit for tax year 2020 the tax return you file in April 2021.

The CARES Act uses the Child Tax Credit CTC eligibility standards. Current JFS guidance is that the expenses paid with these funds and utilized in the calculation of forgiveness will not be deductible expenses for tax purposes. Under the CARES Act eligible Americans who are out of work entirely or underemployed because of reasons related to coronavirus can receive an additional 600 a week for up to four months.

Specifically the Act permits taxpayers including insurers and farming businesses to carry back losses arising in 2018 2019 and 2020 to the five preceding years. According to the Internal Revenue Service IRS website. Tax-exempt health care providers would not be subject to a tax on these funds.

The bill signed into law does not differentiate between a taxpayer who owes money and one who does not owe money. The CARES Act temporarily eliminates both the prohibition on carrybacks and the 80 taxable income limitation to permit taxpayers to claim refunds to boost liquidity. How are they taxed.

All qualifying children who are under age 17 who have not provided for more than half of their own expenses and lived with the taxpayer for more than six months are eligible. Additional information on the Fund unrelated to Federal income taxation is available at The CARES Act Provides Assistance for State and Local Governments webpage Fund Guidance. If governments use Fund payments as described in the Fund Guidance to establish a grant program to support businesses would those funds be considered gross income taxable to a business receiving the grant.

However based on the CARES Act rules that wont apply to forgiven PPP loans. However they are being paid out in advance based on your most recently filed tax. Economic Security Act CARES Act includes a significant number of tax items applicable to individuals and businesses.

After all those funds were not tax free. The only information used to determine eligibility was adjusted gross income AGI. But you should be aware that you can do only one of these indirect rollovers per year he said.

This means that adult dependents such as college students aged 17 and over and elderly dependents do not qualify for the 500 rebate. The CARES Act Coronavirus Aid Relief and Economic Security was the first of several stimulus packages the government has provided Americans to help keep them going through these tough times. Normally a forgiven loan will be counted as cancelled debt which is considered taxable income.

CARES Act benefits. Its time to discuss reporting a CARES Act distribution. COVID-19-related grants to businesses do not qualify as tax-free under the general welfare exclusion and are generally taxable including state and local grants made under the CARES Act Coronavirus.

They do not qualify as disaster relief payments under Section 139. Some of the provisions in the Act allowed for penalty-free use of retirement funds. The taxable portion of your CARES Act Distribution will be subject to 10 federal income tax withholding unless you elect no withholding or additional withholding.

Emergency financial aid grants under the CARES Act for unexpected expenses unmet financial need or expenses related to the disruption of campus operations on account of the COVID-19 pandemic such as unexpected expenses for food housing.

State Conformity To Cares Act American Rescue Plan Tax Foundation

State Conformity To Cares Act American Rescue Plan Tax Foundation

The Cares Act Summary Of Tax Provisions Michael Best Friedrich Llp

American Rescue Plan Act Of 2021 Covid Relief Tax Foundation

American Rescue Plan Act Of 2021 Covid Relief Tax Foundation

The Cares Act The Tax Provisions And What S Next

The Cares Act The Tax Provisions And What S Next

Who Benefits From The Cares Act Tax Cuts Tax Policy Center

Who Benefits From The Cares Act Tax Cuts Tax Policy Center

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

The Cares Act Summary Of Tax Provisions Michael Best Friedrich Llp

Cares Act Business Income Tax Implications Opportunities Rkl Llp

Cares Act Business Income Tax Implications Opportunities Rkl Llp

Federal Coronavirus Relief Cares Act Faq Tax Foundation

Federal Coronavirus Relief Cares Act Faq Tax Foundation

Cares Act Benefits How Are They Taxed Fox Business

Cares Act Implications On Corporate Earnings And Profits E P

Cares Act Implications On Corporate Earnings And Profits E P

A 300 Charitable Deduction Explained

A 300 Charitable Deduction Explained

U S Cares Act Stimulus Payments Not Taxable As Income In Uk

U S Cares Act Stimulus Payments Not Taxable As Income In Uk

Comments

Post a Comment