Free Wire Transfer Bank

The highest wire transfer fee is a whopping 85 for each outgoing foreign wire transfer in US. Charges will vary and can be waived for certain accounts.

![]() Computer Icons Bank Payment Money Wire Transfer Png Clipart Area Bank Bank Account Bank Transfer Brand

Computer Icons Bank Payment Money Wire Transfer Png Clipart Area Bank Bank Account Bank Transfer Brand

If you are wiring money to an account thats not a bank account say a brokerage account.

Free wire transfer bank. In the online banking portal locate the transfer. Look for personal payments or something similar while youre logged in to your account. Der Kontoinhaber einer Bank möchte Geld auf das Konto einer anderen Person überweisen.

For example a 500 wire to a US. If you have online banking set up log into your online bank account and navigate to the wire transfer section of your banks webpage. 30 to 45 per wire transfer.

Up to 15 for requesting tracing services for a previous wire transfer. Diesen Auftrag übergibt der. Alternatively you can do a Google search for.

How it works. Each section of the bank account can be designated for a. Those services are often added to your checking account automatically.

Dollars at Fifth Third Bank while the lowest fee for any type of incoming wire transaction is 13 at. 175 to 35 per wire transfer. These discounts are usually given as a perk for opening more exclusive accounts with that bank.

Best Bank Accounts for Wire Transfers. Wire transfers are a secure way to send money electronically to another person or financial institution. Similar to Discover outgoing domestic wire transfers are.

This may be because of the costs of sending money through an international banking network. How to Do a Free Wire Transfer Domestic Wire Transfer. Some banks will waive the wire transfer fees for their customers.

50 per wire transfer. For Further Credit To. Setting up a borderless bank account with TransferWise is free and only requires an initial 25 deposit.

You can also send wire transfers through companies like Western Union. Once you have an account you can send a wire transfer overseas online or at a local Bank of America branch. To initiate an international wire transfer online.

Banks also offer terrible exchange rates. Banks are an institution which is why they are the first option considered when making international wire transfers. To make an online bank transfer payment gather the account information including the account number and routing number and log into your online banking account.

Bei einem Wire Transfer handelt es sich um eine Bank-Überweisung. Hover over the Transfers tab and then locate the Send money to someone section and select Using their account number at another bank. Outgoing international fee.

For a wire transfer within the US you need the receiving banks routing number and account. 29 Zeilen This is generally a flat fee that your bank will charge you to make the. CIT Bank offers free outgoing wire transfers with a current balance of 25000 or more.

Thats not the only fee youll pay. And naturally this limits your wire transfer options both inbound and outbound. In fact around 80 of international wire transfers are handled by bigger banks.

They are generally considered the safest way to transfer money but they can. Log in to your Bank of America account online. 35 to 65 for sending money to an overseas bank account if its offered at all.

Banks hide other fees in the exchange rate they offer. Capital One 360 Another online bank with generally low fees they offer fee-free incoming wire transfers. 10 to 35 that depends on how you make your transfer for example in a branch or over the phone.

Most banks offer free or inexpensive P2P transfers through Zelle Popmoney or similar vendors. Choose a bank that offers free wire transfers. 40 to 50 per wire transfer.

As youll see below a number of banks dont offer international outbound wire transfers. Which banks offer free wire transfers. Its 10 if your current balance is below 25000.

Zelle is only available in the US but provides a safe and convenient way to send and receive money using an email address or US phone number. Some banks offer free wire transfers and others waive fees for certain accounts. But big banks like Bank of America charge anywhere from 25-65 per outgoing wire transfer.

Those costs can run a bit high though depending on your situation. There will probably be a section on the top toolbar at your banks homepage. Fidelity for example offers free incoming and outgoing domestic and.

Discover warns their designated intermediate bank may apply a 20 currency exchange fee. By certain accounts we mean bigger businesses with. You should note that Zelle is free to use but you should check with your bank in case they charge any fees for using this service.

35 to 45 per wire transfer.

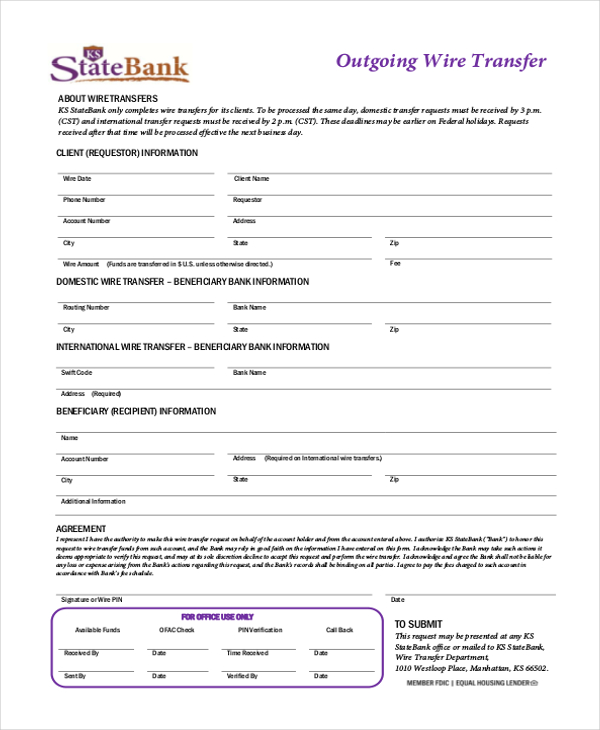

Wire Transfer Bank Transfer Slip

Wire Transfer Bank Transfer Slip

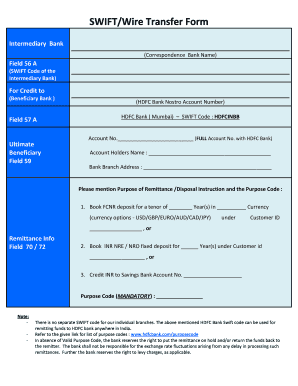

Hdfc Wire Transfer Fill Online Printable Fillable Blank Pdffiller

Hdfc Wire Transfer Fill Online Printable Fillable Blank Pdffiller

Chase Bank Wire Transfer Fees And Instructions

Chase Bank Wire Transfer Fees And Instructions

Wire Transfer Nedbank Payment Money Png 512x512px Wire Transfer Area Automated Clearing House Bank Bank Account

Wire Transfer Nedbank Payment Money Png 512x512px Wire Transfer Area Automated Clearing House Bank Bank Account

Moneygram Logo Png Download 512 512 Free Transparent Bank Account Png Download Cleanpng Kisspng

Moneygram Logo Png Download 512 512 Free Transparent Bank Account Png Download Cleanpng Kisspng

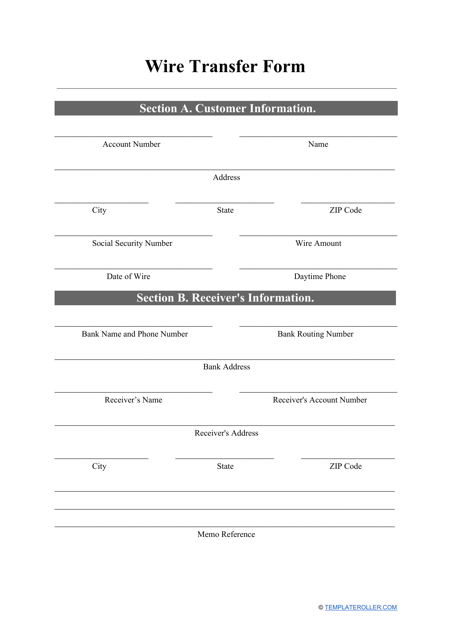

Wire Transfer Form Download Printable Pdf Templateroller

Wire Transfer Form Download Printable Pdf Templateroller

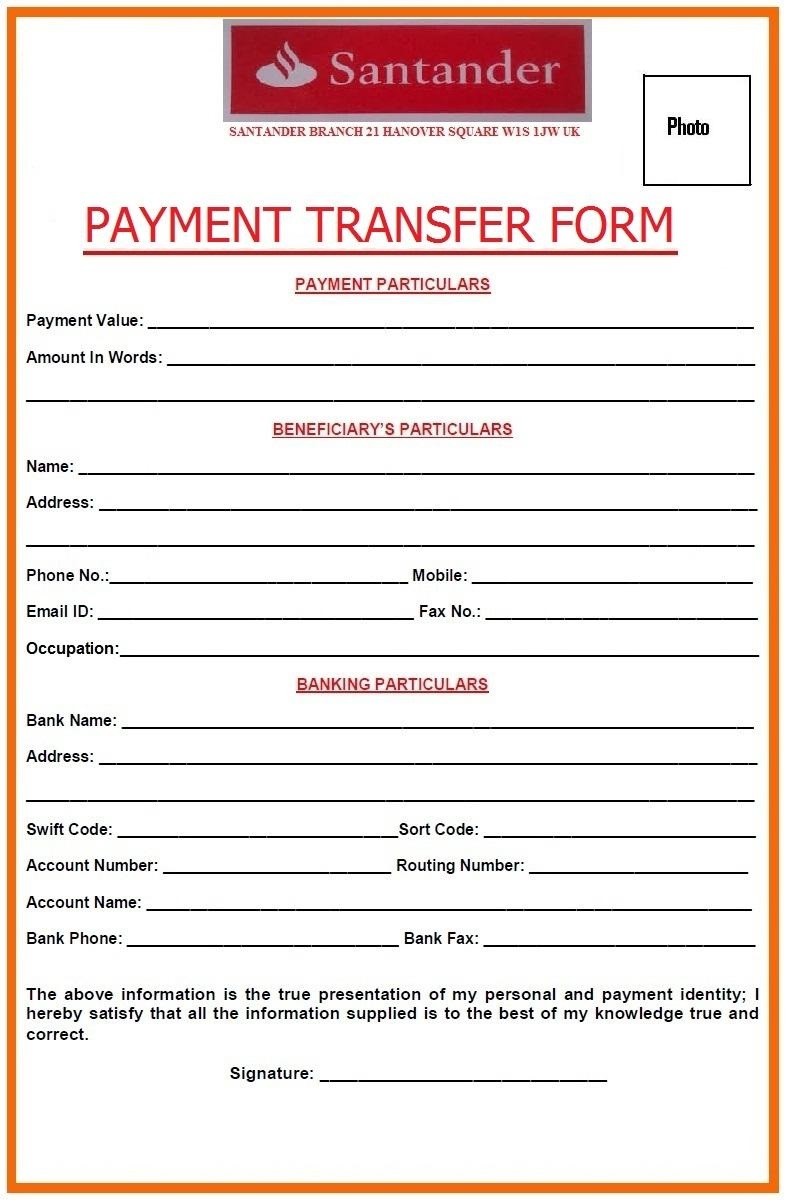

Bank Wire Transfer Form Peatix

Bank Wire Transfer Form Peatix

Credit Card Png Download 512 512 Free Transparent Wire Transfer Png Download Cleanpng Kisspng

Credit Card Png Download 512 512 Free Transparent Wire Transfer Png Download Cleanpng Kisspng

Us Bank Wire Transfer Fees And Instructions

Us Bank Wire Transfer Fees And Instructions

Bank Wire Transfer Form Template Peatix

Bank Wire Transfer Form Template Peatix

3 Ways To Wire Transfer Money Wiki How

3 Ways To Wire Transfer Money Wiki How

/how-to-do-a-bank-wire-315450-v4-5b4766e2c9e77c001a2e43f8.png) Bank Wires How To Send Or Receive Funds

Bank Wires How To Send Or Receive Funds

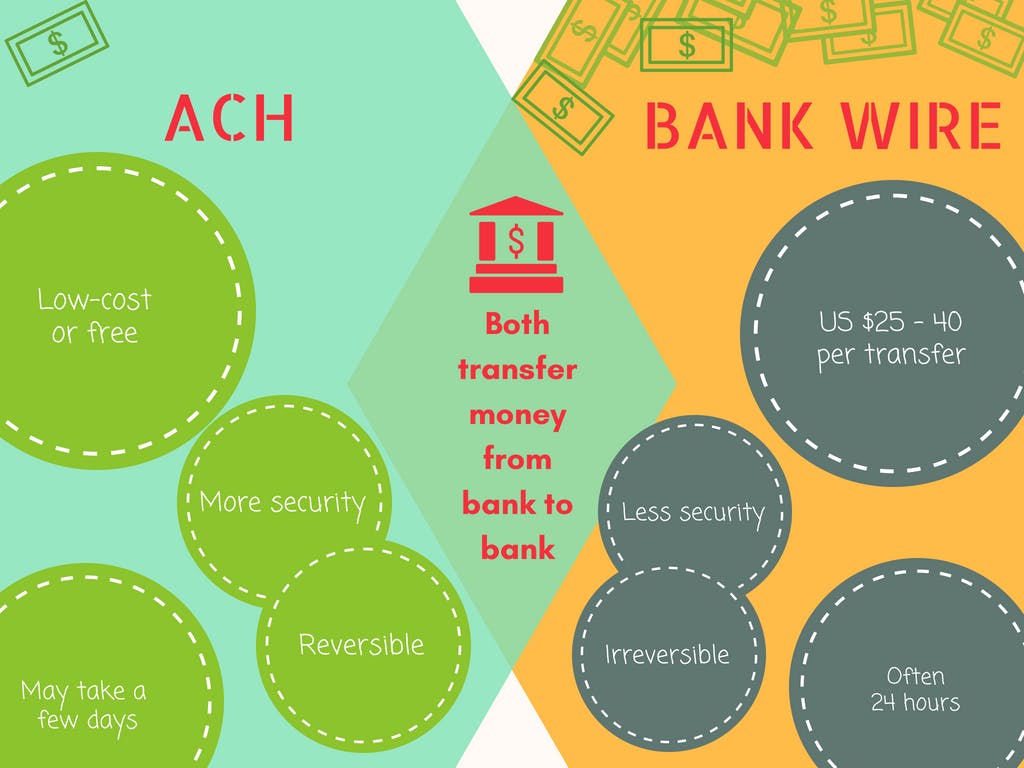

/ach-vs-wire-transfer-3886077-v3-5bc4cc6d4cedfd0051485d64.png) Key Differences Between Ach And Wire Transfers

Key Differences Between Ach And Wire Transfers

Ach Vs Wire Transfers Everything You Need To Know

Ach Vs Wire Transfers Everything You Need To Know

Comments

Post a Comment