How Much Home Can I Get Approved For

51 Zeilen To afford a house that costs 250000 with a down payment of 50000 youd need to. Just enter your income debts and some other information to get NerdWallets recommendation for how big a.

How Much Home Can I Afford Texaslending Com

How Much Home Can I Afford Texaslending Com

Find out how much you can afford to borrow with NerdWallets mortgage calculator.

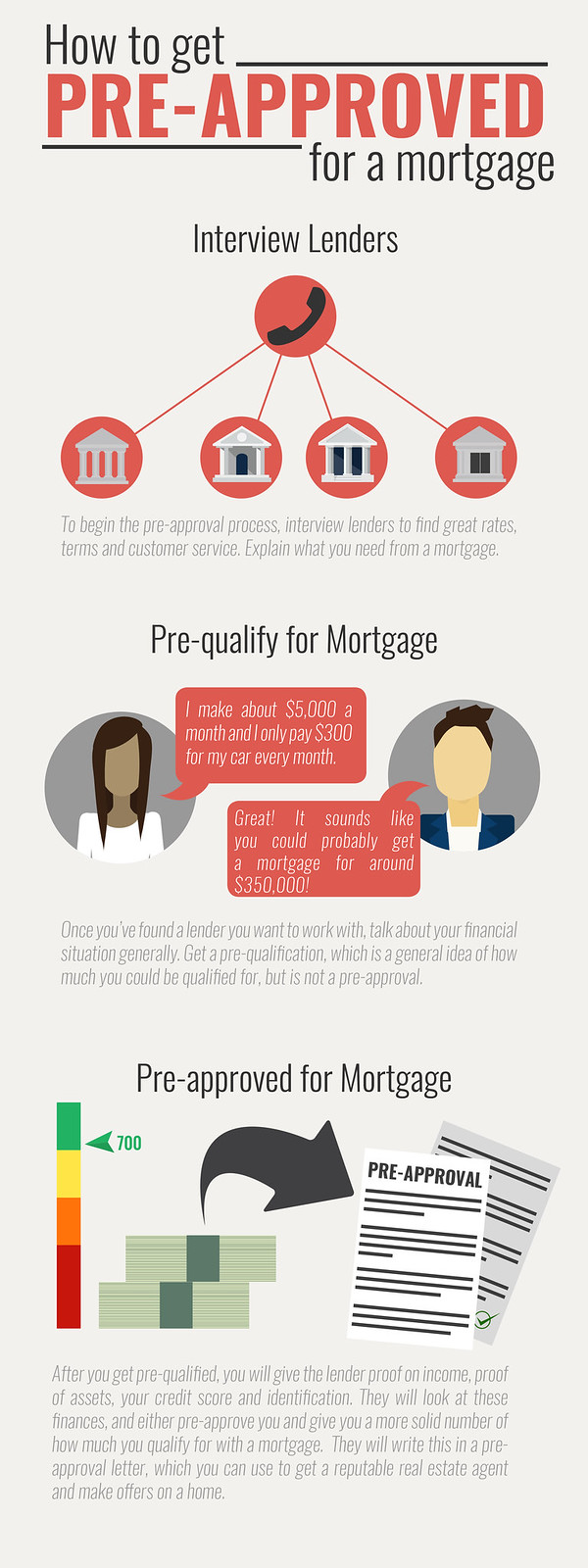

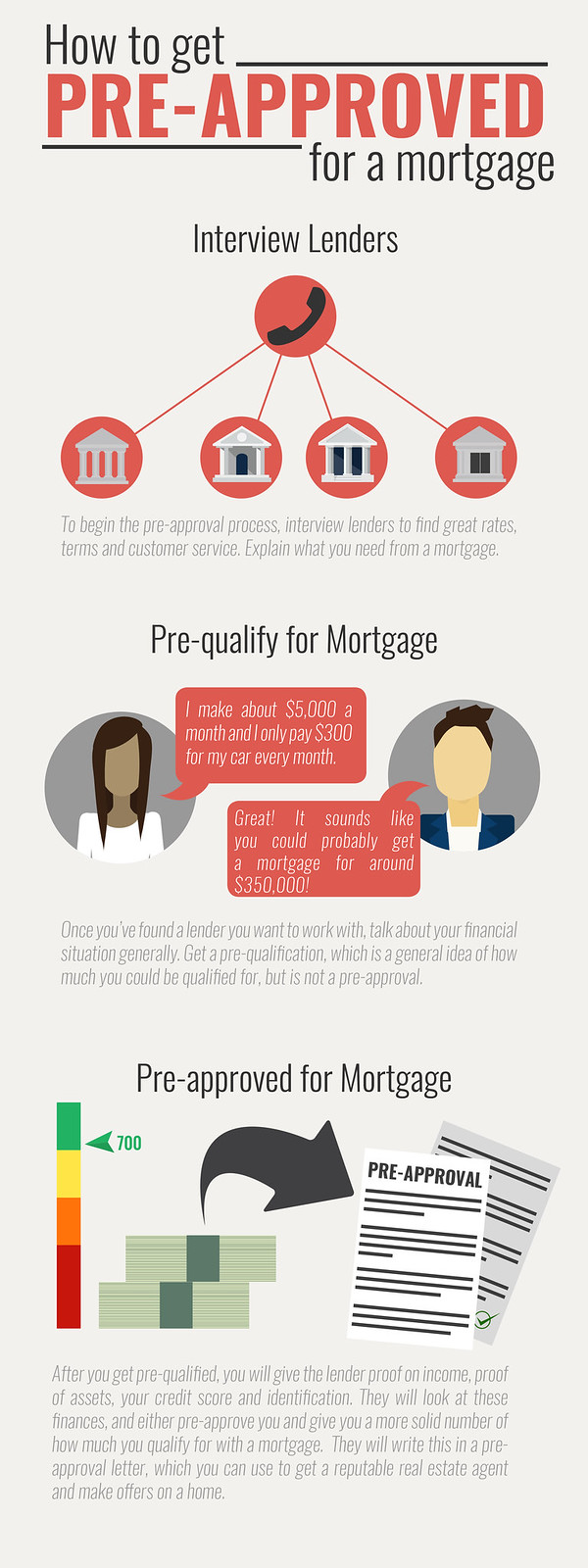

How much home can i get approved for. There isnt a hard cap on DTI ratio for VA loans. A pre-qualification gives you an estimate of how much you can afford while a pre-approval means the lender has checked your credit verified your documentation and approved you for a. Find out the monthly payment so you know what kind of mortgage on 45k salary you can afford.

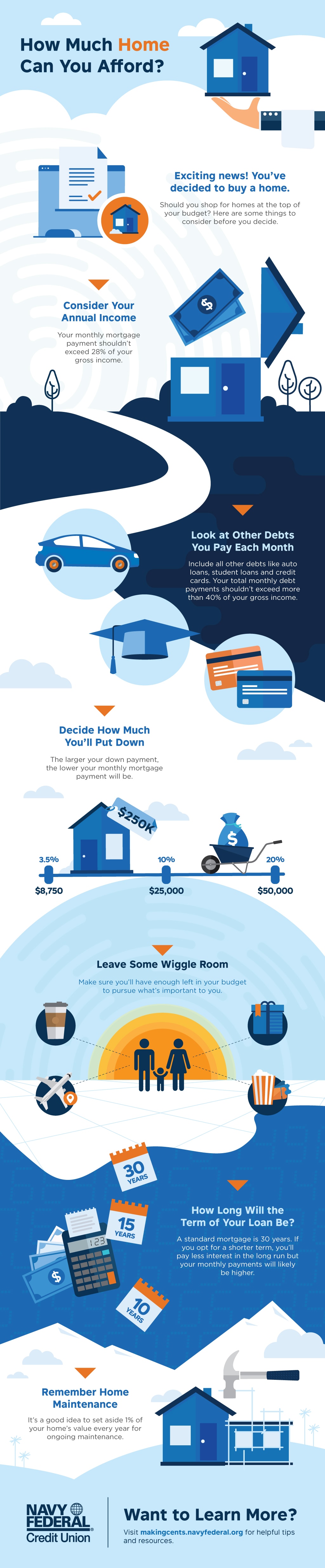

This estimate will give you a brief overview of what you can afford when considering buying a house. Most financial advisers agree that people should spend no more than 28 percent of their gross monthly income on housing expenses and no more than 36 percent on total debt that includes housing as. W2s Many mortgage lenders will require your W-2s for at least the most recent.

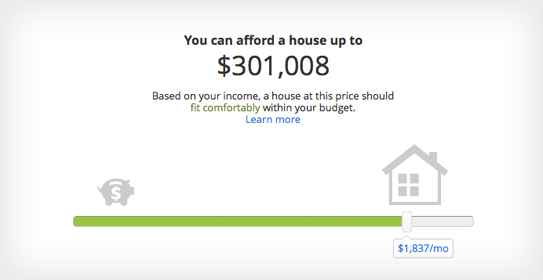

What House Can I. Youll need a pay stub for each job you have and for each person applying for the pre-approval. Our home affordability calculator estimates how much home you can afford by considering where you live what your annual income is how much you have saved for a down payment and what your monthly debts or spending looks like.

Getting pre-approved for a loan can help you find out how much youre qualified to borrow. While online affordability calculators give you a great start there are a ton of factors that go into whats in your budget for your first home including location savings debt and credit score. One influential factor in determining the amount of money you can borrow on a home loan is your debt-to-income DTI ratio.

Get pre-approved for a mortgage. Your total mortgage payment should be no more than 28 of your gross monthly income. To get a full pre-approval youll need to be prepared to provide the following documentation.

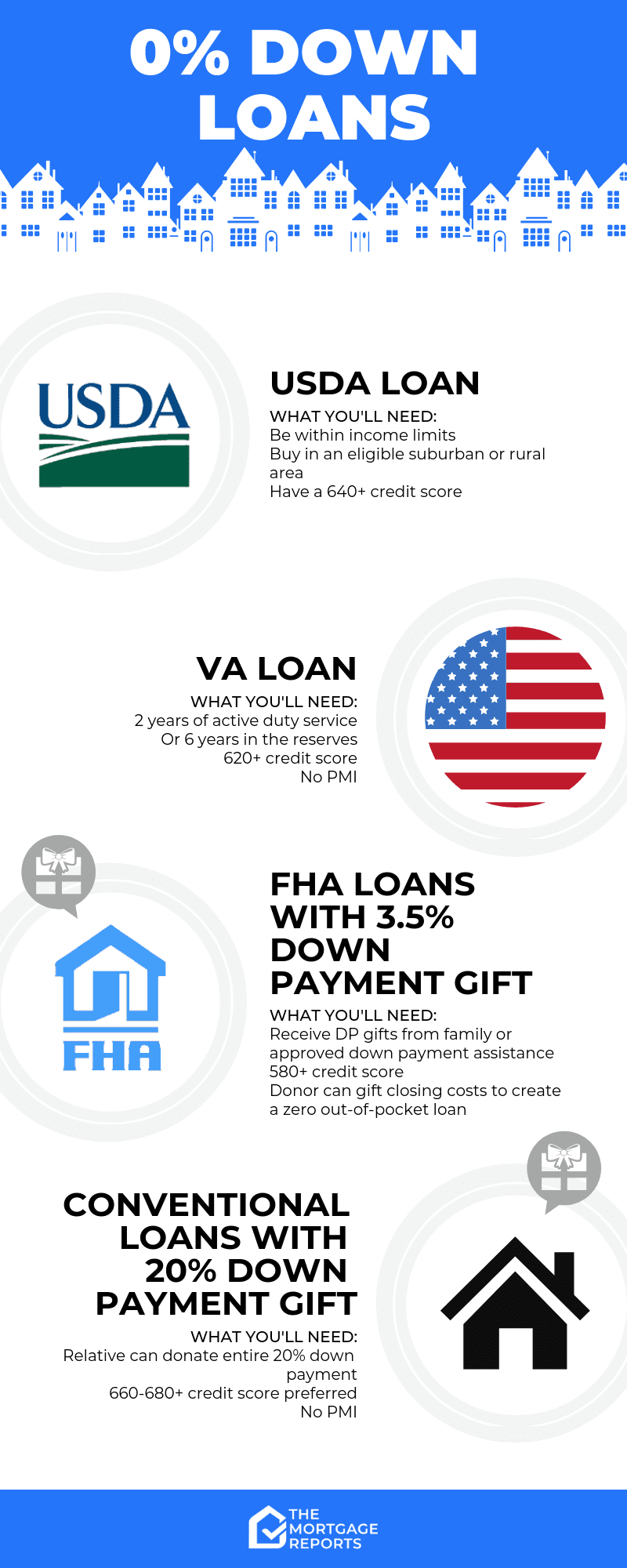

Buyers can be pre-qualified or pre-approved. Each loan program has different rules regarding the down payment required. This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income and your total monthly debt including your anticipated monthly mortgage payment and other debts such as car or student loan payments should.

Your required down payment can range anywhere from 3-20 of the homes purchase price. While you may have heard of using the 2836 rule to calculate affordability the correct DTI ratio that lenders will use to assess how much house you can afford is 3643. Benchmarks can vary by lender.

DTI ratio reflects the relationship between your gross monthly income and major monthly debts. Pay stubs Youll need to provide your most recent pay stub which must show your year-to-date earnings. How lenders determine what you can afford.

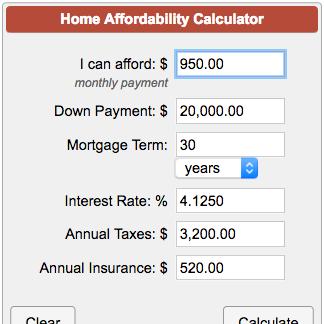

This rule is based on your debt service ratios. Your down payment requirements may depend on your lender the type of home loan you choose and the type of property you are buying. This calculator uses these guidelines for determining how much house you can afford which are similar to common underwriting criteria that mortgage lenders use.

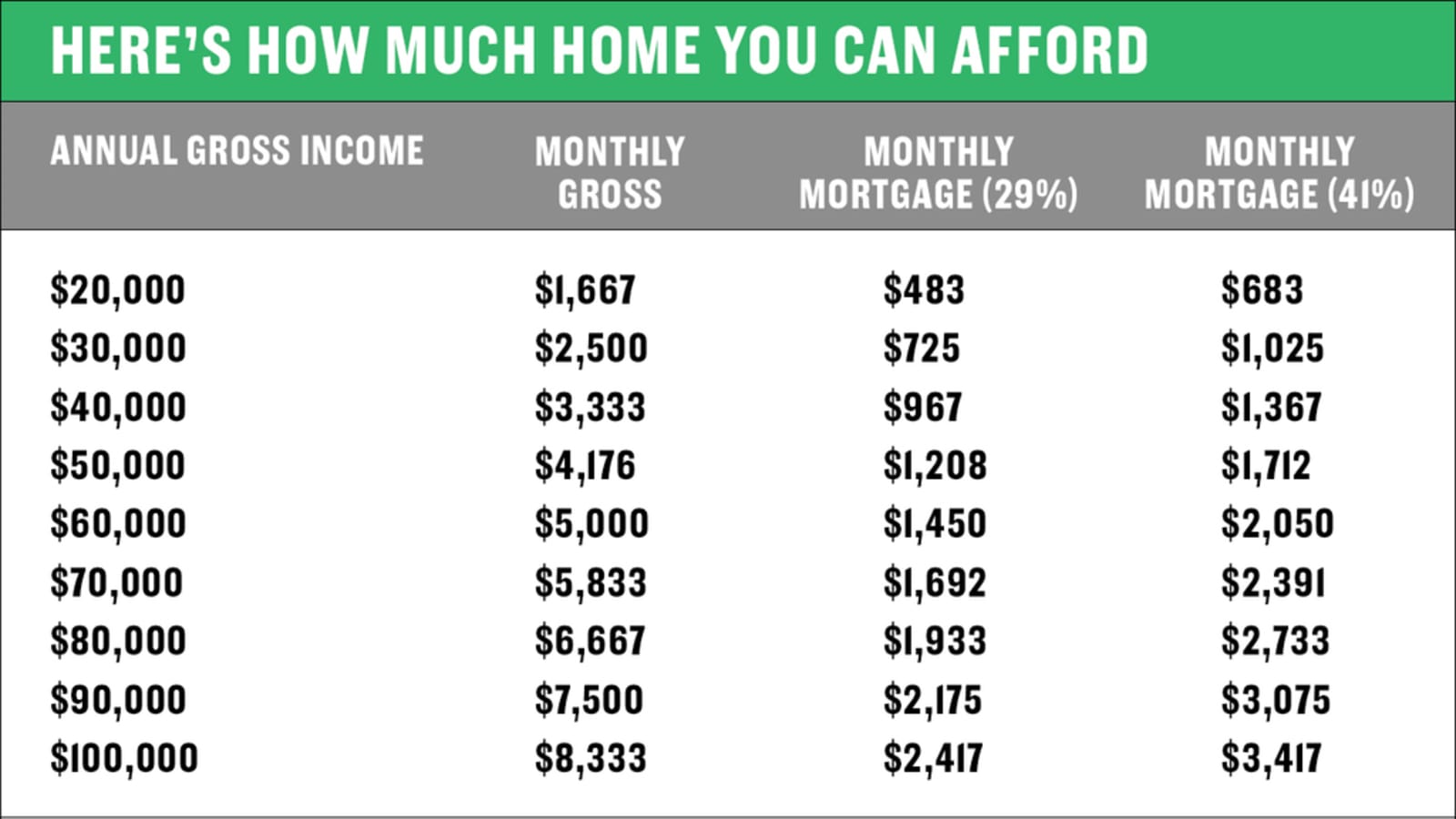

For somebody making 100000 a. Lenders offer a variety of different loan programs including low down payment options. How the home affordability calculator works.

The house affordability calculator will estimate how much home you can afford if you make 45000 a year with options to include property tax home insurance HOA fees and more. Simply enter your monthly income expenses and expected interest rate to get your estimate. Just like lenders our Affordability Calculator looks at your Debt-to-Income Ratio DTI to determine what home price you can afford.

But remember that when it comes to affordability the amount a lender will lend you and the amount you can comfortably pay without stretching your budget too thin could be very different. Adjust the loan terms to see your estimated home price loan amount down payment and monthly payment change as well. For our example lets suppose you have an annual income of 68000.

To help you get started you can use our calculator on top to estimate the home price closing costs and monthly mortgage payments you can afford based on your annual income. Once you find the price you can afford contact a Home Lending Advisor or visit your local branch to get started. Youre looking to get a 30-year fixed-rate loan at 325 APR.

Our calculator uses the information you provide about your income and expenses to assess your DTI ratio. For your down payment and closing costs youve saved. In order to be approved for a mortgage you will need at least 5 of the purchase price as a down payment if your purchase price is within 500000.

Estimate How Much House You Can Afford. Simply take your gross income and multiply it by 25 or 3 to get the maximum value of the home you can afford. The rule of thumb is you can afford a mortgage where your monthly housing costs are no more than 32 of your gross household income and where your total debt load including housing costs is no more than 40 of your gross houshold income.

It may seem like a lot but it is possible to find a home you can actually afford while making just 70000 a year. To calculate how much home you can afford with a VA loan VA lenders will assess your debt-to-income ratio DTI. Estimate how much home you can afford with our affordability calculator.

If your purchase price is between 500000 and 1000000 your minimum down payment is 5 of the first 500000 and 10 of the price between 500000 and 1000000.

Why Mortgage Pre Approval Is Important

Why Mortgage Pre Approval Is Important

How Much House Can You Afford Money Under 30

How Much House Can You Afford Money Under 30

Top 3 Do S And Don Ts Of Buying Your First Home In Edmonton By Matt Unrau Issuu

Top 3 Do S And Don Ts Of Buying Your First Home In Edmonton By Matt Unrau Issuu

How Much Home Can You Afford Makingcents Navy Federal Credit Union

How Much Home Can You Afford Makingcents Navy Federal Credit Union

What Should You Ask Your Lender When Buying A House Costello Rei

What Should You Ask Your Lender When Buying A House Costello Rei

How Much House Can I Afford Credit Com

How Much House Can I Afford Credit Com

Here S How To Figure Out How Much Home You Can Afford

Here S How To Figure Out How Much Home You Can Afford

How To Buy A House With 0 Down In 2021 First Time Buyer

How To Buy A House With 0 Down In 2021 First Time Buyer

How Much Home Can You Afford Advanced Topics

How Much Home Can You Afford Advanced Topics

Guide To Getting A Mortgage In 4 Steps Meridian Credit Union

Guide To Getting A Mortgage In 4 Steps Meridian Credit Union

How Much House Can I Afford Insider Tips And Home Affordability Calculator

How Much House Can I Afford Insider Tips And Home Affordability Calculator

Affordability Calculator How Much House Can I Afford Zillow

Affordability Calculator How Much House Can I Afford Zillow

How And Why To Get Pre Approved For A Mortgage

How And Why To Get Pre Approved For A Mortgage

Comments

Post a Comment