Varo Atm Limit

Users can send up to 2000 to other Varo users each 30-day period. As weve outlined above Varo is definitive on the amount you can transfer and what the time limit on that amount is.

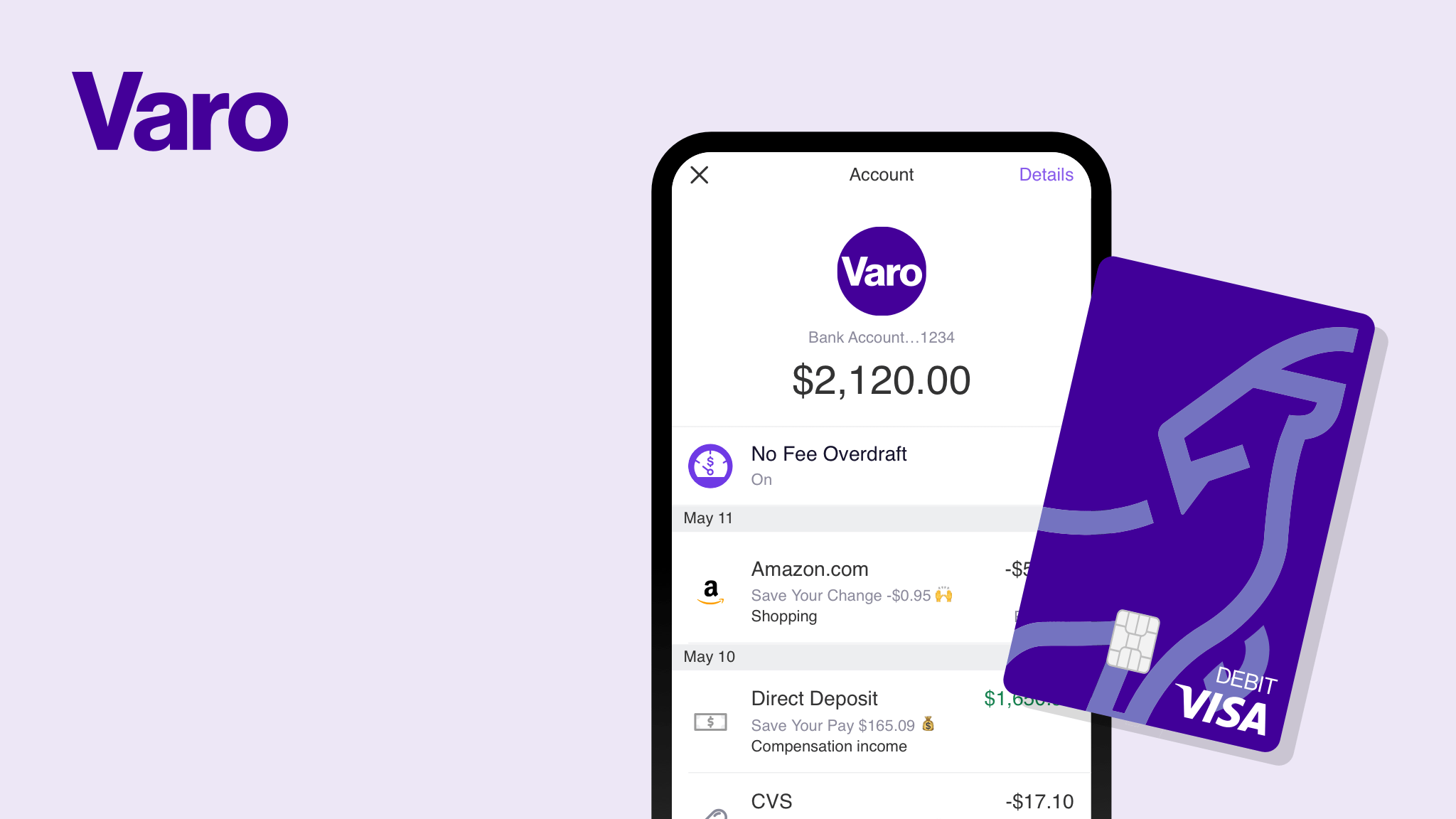

Online Banking With No Fees Varo Bank

Online Banking With No Fees Varo Bank

The Varo Visa Debit Card is issued by The Bancorp Bank pursuant to a license from Visa USA.

Varo atm limit. Inc and may be. Additionally customers may not like the spending caps and ATM limits Varo sets up if bill payments for example a mortgage payment exceed 2500 daily for purchases or 1000 daily for cash withdrawals. Theres a 2500 daily limit for purchases made with the Varo debit card.

Here are just a few of the benefits that come with Varo banking. The ATM operator may charge an additional fee. Your deposits are FDIC insured to at least 250000 through The Bancorp Bank.

Bank account services provided by The Bancorp Bank. The Varo Visa Debit Card is issued by The Bancorp Bank pursuant to a license from Visa USA. If you want to.

How Do I Add Money to My Varo Bank Account. You can withdraw a maximum of 500 per day. You can deposit up to 1000 per day with a maximum of 5000 per month.

You can also use your card to get cash. No monthly fees no foreign transaction fees no ATM withdrawal fees at 55000 Allpoint ATMs in stores like Walgreens Target and CVS. After October 1 2020 Bank Account Services provided by Varo Bank NA.

You can take out up to 750 cash per calendar day from ATMs. For further details see the Varo Bank Account Agreement. Is there a spending limit on my Varo Debit Card.

However certain Green Dot locations may have their own limits on how often or how much cash you can deposit to your Varo Bank Account. Like most of its competitors Varo. Does Varo have a savings account.

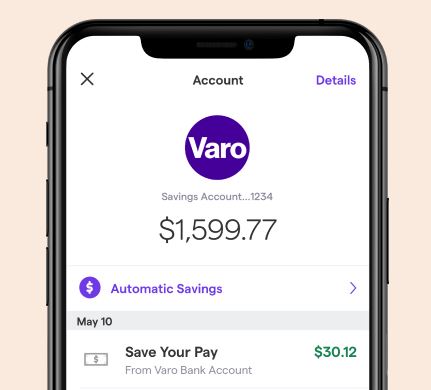

Inc and may be used everywhere Visa debit cards are accepted. Your deposits are FDIC insured up to 250000 through Varo Bank NA. A Savings Account with no minimum balance requirement.

If you use an ATM outside the Allpoint network Varo charges 250 per withdrawal the ATM operator may set their own fees on top of that. And thats in addition to whatever other fees are charged by the non-Allpoint ATMs operator. You can spend up to 2500 per calendar day with your Varo debit card.

Your deposits are FDIC insured to at least 250000 through The Bancorp Bank. Like any other debit card a Varo Card can be used to make purchases both online and offline as well as make withdrawals. Like most of its rivals Varo offers an easily accessible bank account with no monthly fees or minimum balance plus high-interest savings and a modern mobile app experience.

When you visit an Allpoint ATM nearby you can withdraw a maximum of up to 500 per day using your Varo Visa Debit Card. A Varo Card for those who are not familiar with it is basically a debit card that anyone who opens a Varo Bank account receives. Bank account services provided by The Bancorp Bank.

In addition the Varo Bank Account and Varo Savings Account balances must not drop below 000 on any calendar day of the month and the daily balance in the Varo Savings Account at close of business on each calendar day of the month must not exceed 5000. The Varo Visa Debit Card is issued by The Bancorp Bank pursuant to a license from Visa USA. If you withdraw from an ATM the maximum amount you can withdraw is 750 per calendar day.

When you check out at a store use your Varo Visa Debit Card and follow the on-screen prompts to get cash up to 500 per calendar day. But when you visit a bank or credit union branch using the Over the Counter option you can withdraw up to 1000day. This is the combined daily limit for ATM withdrawals over-the-counter withdrawals and cash back at point of sale.

It also increased its deposit and ATM limits and partnered with job platforms Steady and Wonolo to help connect its customers to new work opportunities. To use a Vero Card youll need to. However Varo has an overall withdrawal limit of 1000day.

There is a 250 ATM cash withdrawal fee assessed by Varo Bank for all non-Allpoint ATM transactions out of network transactions. Inc and may be. Can I deposit cash to my Varo Savings Account.

All you need is a smartphone and the Varo mobile app to get started. If they reach that limit they must wait for the next 30-day period to begin. Two other ways to get cash.

What is the Varo withdrawal limit. However if you use a non-Allpoint ATM youll be charged a 250 ATM withdrawal fee by Varo effective February 19 2020. Varo offers online checking accounts called a Varo Bank Account but no paper checks.

Varo Checking Account Review April 2021 Finder Com

Varo Checking Account Review April 2021 Finder Com

Varo Checking Account Review April 2021 Finder Com

Varo Checking Account Review April 2021 Finder Com

![]() Varo Money Online Checking Account Review 2021 Mybanktracker

Varo Money Online Checking Account Review 2021 Mybanktracker

Varo Bank Review Smartasset Com

Varo Bank Review Smartasset Com

Online Banking With No Fees Varo Bank

Online Banking With No Fees Varo Bank

Big News Varo Money Becomes First Us Fintech To Receive A National Bank Charter

Big News Varo Money Becomes First Us Fintech To Receive A National Bank Charter

Online Banking With No Fees Varo Bank

Online Banking With No Fees Varo Bank

6 Things To Know About Varo Bank Clark Howard

6 Things To Know About Varo Bank Clark Howard

Challenger Bank Varo Soon To Become A Real Bank Raises 241m Series D Techcrunch

Challenger Bank Varo Soon To Become A Real Bank Raises 241m Series D Techcrunch

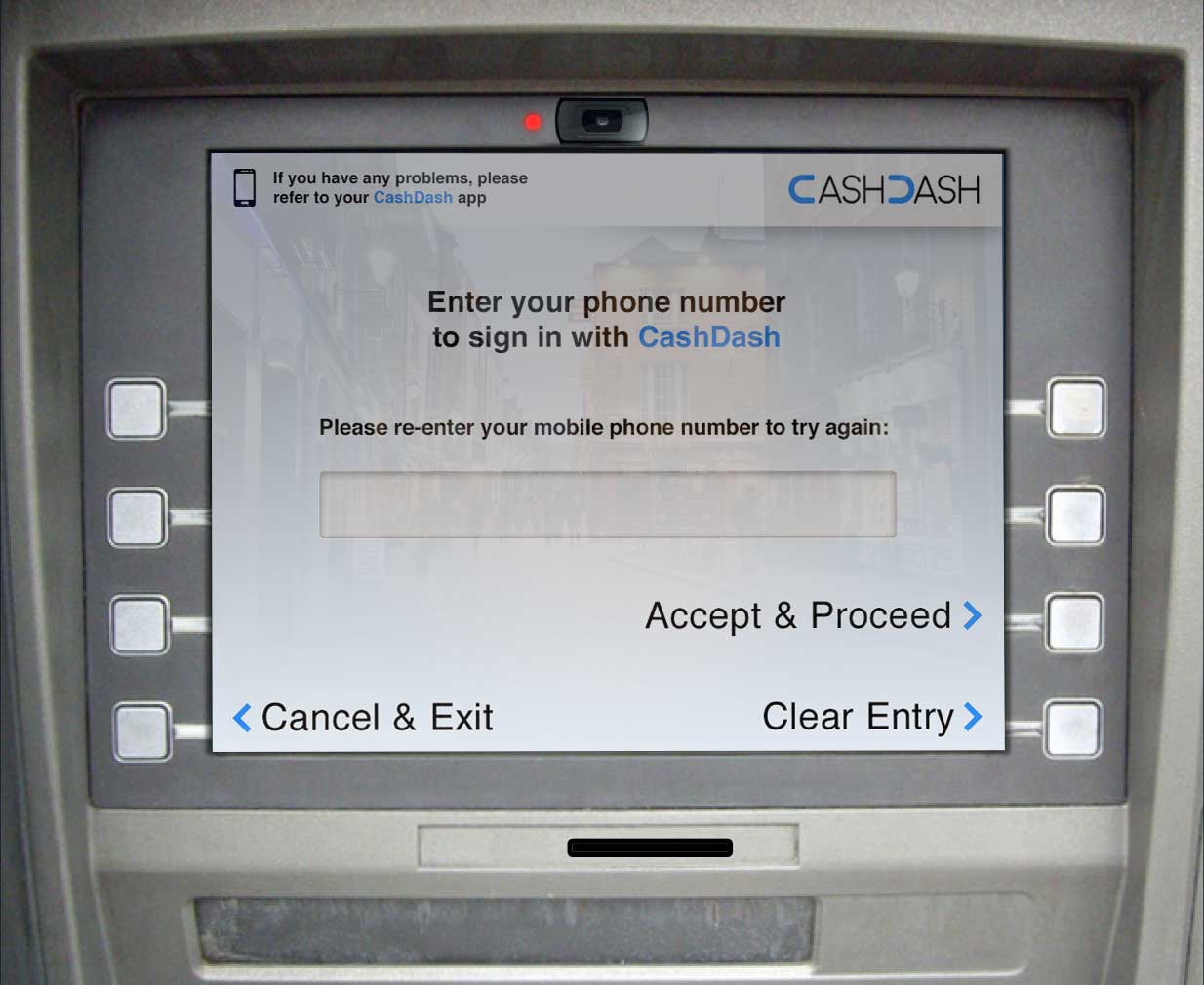

Cashdash Lets You Withdraw Cash From Atms Without A Debit Card

Cashdash Lets You Withdraw Cash From Atms Without A Debit Card

Varo Money Raises 241 Million As It Moves Closer To Becoming A National Digital Bank

Varo Money Raises 241 Million As It Moves Closer To Becoming A National Digital Bank

Varo Review Is A Varo Bank Account Right For You Gobankingrates

Varo Review Is A Varo Bank Account Right For You Gobankingrates

Varo Raises 241m Series D With New Investor Gallatin Point Capital Fintech Futures

Varo Raises 241m Series D With New Investor Gallatin Point Capital Fintech Futures

Comments

Post a Comment