Is Merrill Edge Good

The education section of course is by far probably one of the most notable bonuses to trading at. Merrill Edge was launched in 2010 and as such doesnt have a long track record of customer relations or financial stability.

Merrill Lynch Vs Fidelity Compare Ira Accounts Fees Cost 2021

Merrill Lynch Vs Fidelity Compare Ira Accounts Fees Cost 2021

If you are a beginner investor and already have a Bank of America account Merrill Edge is a good broker to use to get started in online stock trading at a reasonable price.

:max_bytes(150000):strip_icc()/Buy-writeOrderTicket1-11b3183ab8e44d45b09fb17a4868cdeb.png)

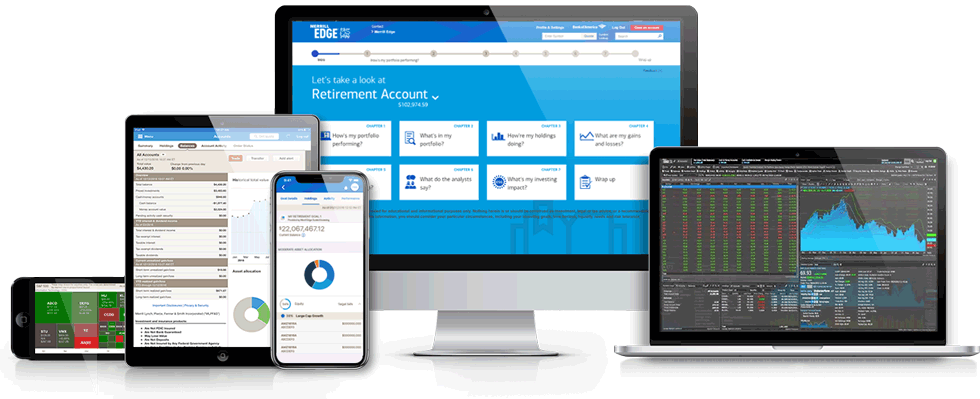

Is merrill edge good. Merrill Edge could be a great fit for active traders and research-focused investors who want commission-free trades and inexpensive brokerage accounts. Its selection is just too small. The Merrill Edge Marketpro trading software is reliable and good for active clients.

It is now one of the top online brokerages that can meet the needs of nearly any investor. Its financial strength ratings are good but not stellar. With an advanced active trading app excellent research and education resources and no commissions for most trades it may be time to reconsider Merrill Edge.

So its too bad. If youre the kind of customer who likes talking to agents on the phone it helps to have 247 access to customer support too. This means that you have the advantage of banking to help you simplify your finances as well as gaining access to Merrill Lynchs award-winning research investment tools and call center counsel.

Overall Merrill Edge provides customers with a fantastic well-rounded offering. Looking for funds is fairly straightforward as well. Brokerage fees associated with but not limited to margin transactions special stock registrationgifting account transfer and processing and termination apply.

If you need to learn about the basics of funds the brokers educational articles will lead you step-by-step. Merrill Edge has a very good mutual fund section with lots of information. The Merrill Edge website has lots of information but their search feature needs some serious re-working.

There are no minimum balances required to sign up and the company also offers lots of helpful research tools. Merrill waives its commissions for all online stock ETF and option trades placed in a Merrill Edge Self-Directed brokerage account. Merrill Edge has no recurring fees and no minimums for its self-directed accounts.

Options trades are also possible within the platform and make the products and services offered complete. With its customer service and educational materials Merrill Edge would be a decent broker for beginners. Merrill Edge appeals to casual traders with a powerful combination of robust research and competitive pricing including unlimited free trades on stocks and.

Merrill Edge is part discount brokerage firm and part subsidiary of Bank of Americas BofA retail banking division. Investors will appreciate Merrill Edges 0 trades robust research and reliable customer service. Merrill Edge seems like a good investment platform for beginners.

Merrill Edge is a good choice for investors who want great education and research tools. Investors who want to buy mutual funds should take a look at the Ally Invest. Thats a small perk but its a nice one.

We definitely do not recommend Merrill Edge for mutual fund investors. When I told them the market actually went up 2 they said a good. Seasoned investors who really care about platform and price points should potentially look elsewhere.

Merrill Edge Roth IRA Online Experience. Merrill Edge has some helpful online tools and may be a good option for those who bank with Bank of America and want to see their banking and investment accounts side by side. Active stock ETF and option traders will be better served with Webull.

There are also short videos that cover mutual fund basics. FINRA data is not available specifically for Merrill Edge and is impossible to pull from Merrill Lynchs FINRA data. Merrill Edge allows you to reinvest your dividends into fractional shares of stock letting you roll that full payout into more equity.

It is also a great option for those who meet the 30 free trades requirements. Similarly Bank of America customers will discover that Merrill Edge is an excellent extension of the Bank of America brand. Because the company has no minimum deposit requirement or low-balance fee it would also be a good pick for small accounts.

Taken solely as an online brokerage. Who Merrill Edge Is For Beginning and intermediate-level long-term investors will be well-served by Merrill Edges technology and wide range of services. The company charges 0 commissions on all.

Merrill Edge Vs Merrill Lynch Differences Are They The Same

Merrill Edge Vs Merrill Lynch Differences Are They The Same

Merrill Edge Review 3 Key Findings For 2021 Stockbrokers Com

Merrill Edge Review 3 Key Findings For 2021 Stockbrokers Com

Merrill Edge Review 2021 Pros And Cons Uncovered

Merrill Edge Review 2021 Pros And Cons Uncovered

What Is Merrill Edge Investing Your Way With Our Help

What Is Merrill Edge Investing Your Way With Our Help

Merrill Edge Merrilledge Twitter

Merrill Edge Merrilledge Twitter

Merrill Edge Review 3 Key Findings For 2021 Stockbrokers Com

Merrill Edge Review 3 Key Findings For 2021 Stockbrokers Com

Merrill Edge Review Pros Cons And Who Should Open An Account

Merrill Edge Online Investing Trading Brokerage And Advice

Merrill Edge Online Investing Trading Brokerage And Advice

Best Penny Stock Brokerage Firms Merrill Edge Pre Market Trading Hours Jcf

Merrill Edge Broker Review How They Compare To Other Brokers

Merrill Edge Broker Review How They Compare To Other Brokers

Merrill Edge Trading Fees How To Find Future Stock Price Conexao Videos Inteligentes

Merrill Edge Review 2021 Pros And Cons Uncovered

Merrill Edge Review 2021 Pros And Cons Uncovered

/LandingPage2-3aab5bc161c048c0a9c218a287b70a8a.png)

Comments

Post a Comment