Percent Of Taxes Paid By Top 1

And the top 1 pay 373 of the total. State and local sales and property taxes.

Who Pays Income Taxes Foundation National Taxpayers Union

Who Pays Income Taxes Foundation National Taxpayers Union

As this data visualization clearly shows the top 1 pay much more than taxpayers of any other income level.

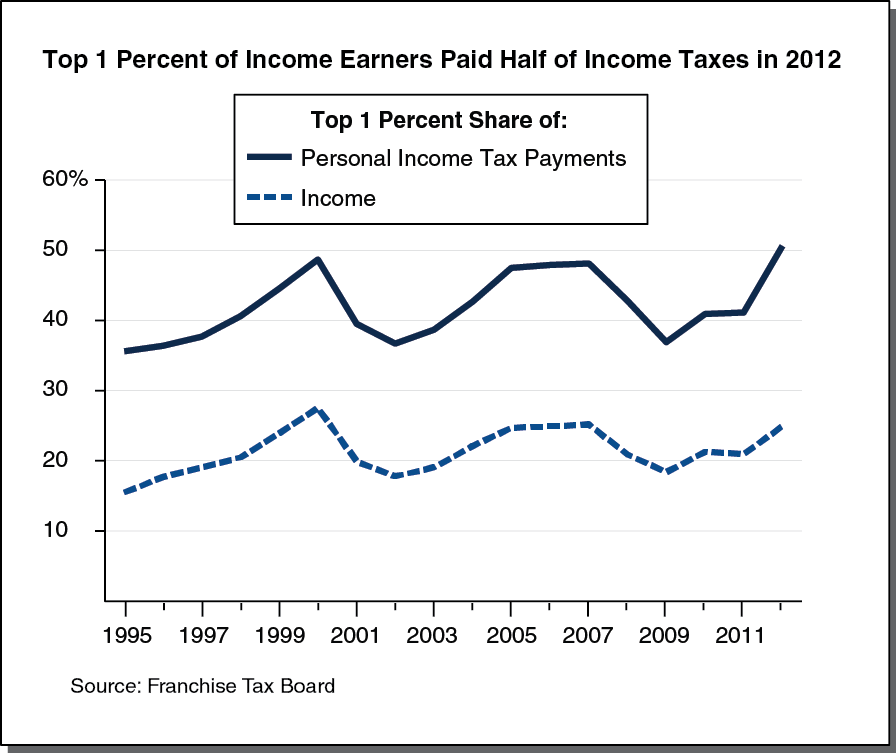

Percent of taxes paid by top 1. Earners paid roughly 37 of all federal income taxes. Percent between the share of taxes paid and the income earned by the top 1 percent. Explore the latest videos from hashtags.

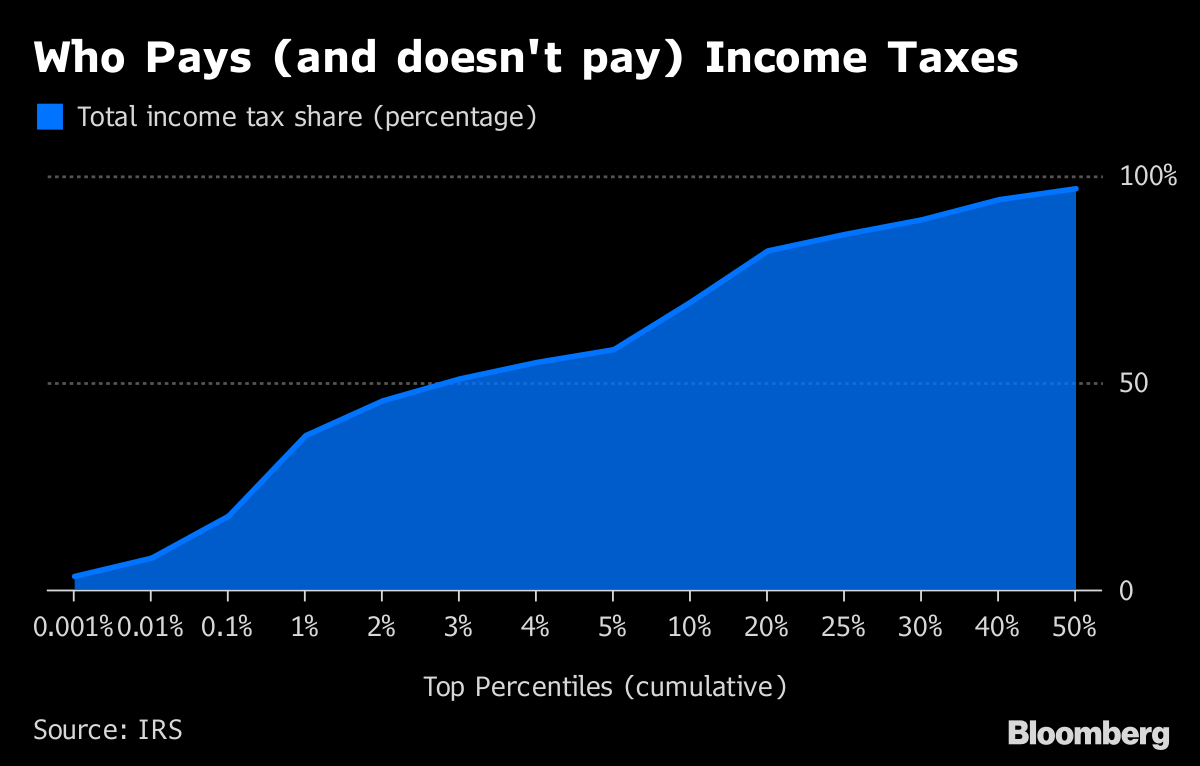

The top 20 percent of Americans pay almost 90 percent of all federal income taxes. Thats how a progressive system works but the actual equation is a bit more complicated than that. Di Madilovestiktok lauren laureeennm Chantz Irelandinvestorchantz europepoliticeuropepolitic Yenisley Acebo Diazchicotaxes.

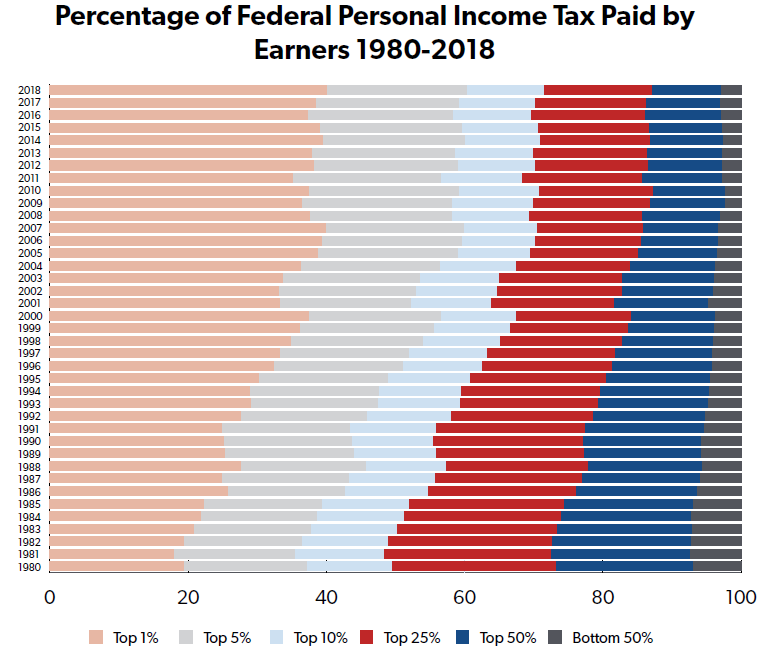

Of those 1000 people 100 people the top 01 of all taxpayers pay 195. Since 2001 the share of federal income taxes paid by the top 1 percent increased from 332 percent to a new high of 401 percent in 2018. The bottom 50 percent of Americans pay just 3.

Thats actually a greater share. When looking at a subset of total taxes namely personal income taxes the imbalance between taxes paid and income earned is even larger for both the top 20 and top 1 percent. Meanwhile the share of income tax paid by the top 1 of taxpayers a smaller slice of the population because so many people pay no income tax has.

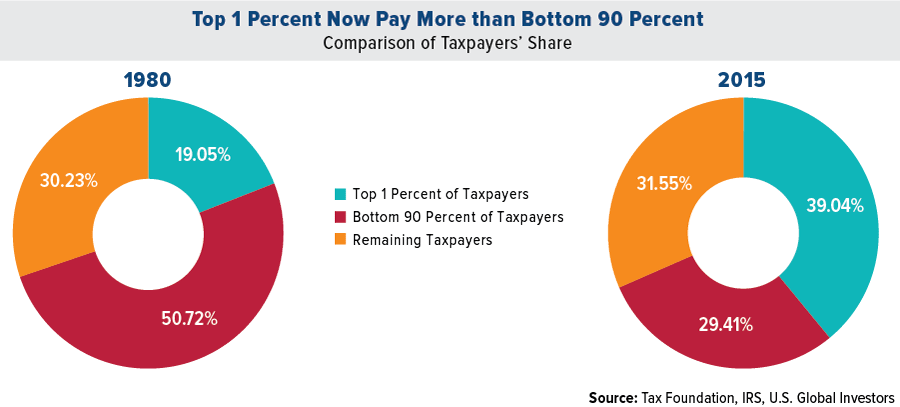

In 2018 the top 1 of US. The top 1 of taxpayers those who earn 515371 or more paid 3847 of the total tax revenue collected in 2017 according to the latest figures from the IRS. Explore the latest videos from hashtags.

Last October Bloomberg reported that the top half of taxpayers pay 97 of all federal income tax. Those earning the 2 to 5 of the highest wages in America pay 205 of all Federal Income Tax. If a tax bill that provided that 39 of the benefits went to the top 1 was enacted there would have been very little.

This suggests that policy makers wishing to mitigate regressive features of the tax system should look elsewhere. Any income the first person earns over 207350 is going to be taxed at 35 as of 2020 whereas the second person will pay a top rate of just 12. Imagine the top One Percent is represented by 1000 people standing in a room.

Percent of taxes paid by top 1 1384K viewsDiscover short videos related to percent of taxes paid by top 1 on TikTok. True Progressive Xtrueprogressivex investwithaceinvestwithace Di Madilovestiktok lauren laureeennm Melissa Annmbanks1860. Prior to enactment of the bill the top 1 paid about 39 of Federal taxes.

In 2018 the top 50 percent of all taxpayers paid 971 percent of all individual income taxes while the bottom 50 percent paid the remaining 29 percent. Watch popular content from the following creators. Notably over time the top 1 percents share of total taxes paid has increased from 113 percent in 1997 to 147 percent in 2017.

Thats more than the bottom. The top 1 percent of American earners pay almost 40 percent of all federal income taxes. It is almost double as much as the next bracket of top incomes.

The top 5 paid around 58. According to an analysis by the nonpartisan Tax Policy Center the top 1 those making over 783300 24 million on average will pay about an average federal tax rate of 302 in 2019. Watch popular content from the following creators.

Percentage of taxes paid by top 1 percent 13M viewsDiscover short videos related to percentage of taxes paid by top 1 percent on TikTok.

The Top 1 Percent Pay 35 Percent Of Federal Income Taxes

The Top 1 Percent Pays More In Taxes Than The Bottom 90 Percent Tax Foundation

The Top 1 Percent Pays More In Taxes Than The Bottom 90 Percent Tax Foundation

Top 1 Paid More In Federal Income Taxes Than Bottom 95 In 07 The New York Times

Top 1 Paid More In Federal Income Taxes Than Bottom 95 In 07 The New York Times

How Much Do The Top 1 Percent Pay Of All Taxes

Buffett S Case For Minimum Tax On The Rich Fails On All Accounts Tax Foundation

Buffett S Case For Minimum Tax On The Rich Fails On All Accounts Tax Foundation

Summary Of The Latest Federal Income Tax Data 2018 Update

Summary Of The Latest Federal Income Tax Data 2018 Update

Yes The Top 1 Pct Do Pay Their Fair Share In Income Taxes Mining Com

Top 3 Of U S Taxpayers Paid Majority Of Income Tax In 2016 Bloomberg

Top 3 Of U S Taxpayers Paid Majority Of Income Tax In 2016 Bloomberg

What Does It Take To Be In The Top 1 Percent Not As Much As You Think Seeking Alpha

What Does It Take To Be In The Top 1 Percent Not As Much As You Think Seeking Alpha

The Top 1 Percent Pays More In Taxes Than The Bottom 90 Percent Tax Foundation

The Top 1 Percent Pays More In Taxes Than The Bottom 90 Percent Tax Foundation

Effective Income Tax Rates Have Fallen For The Top One Percent Since World War Ii Tax Policy Center

Effective Income Tax Rates Have Fallen For The Top One Percent Since World War Ii Tax Policy Center

Yes The Top 1 Percent Do Pay Their Fair Share In Income Taxes U S Global Investors

Comments

Post a Comment