Vantagescore Vs Fico Score

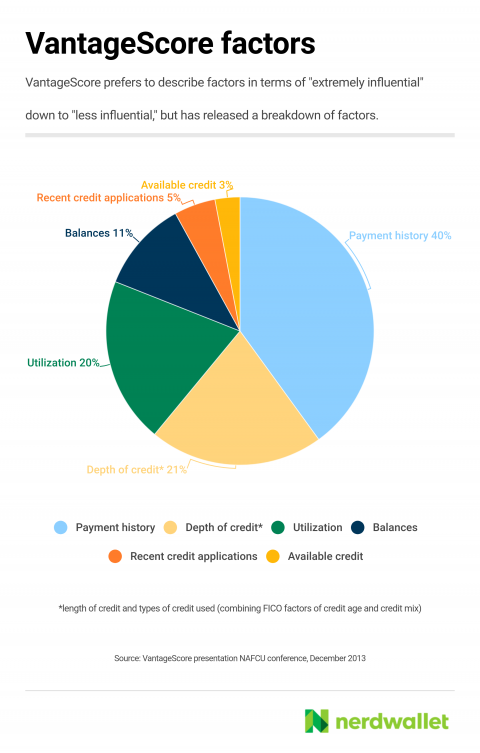

There are however some key differences in how the two scores are calculated including FICO giving more weight to payment history and VantageScores latest version emphasizing total credit usage and balances. However keeping both scores in mind can give you a much more well-rounded understanding of your credit health.

What The Difference Between Fico Credit Score And Vantagescore Quora

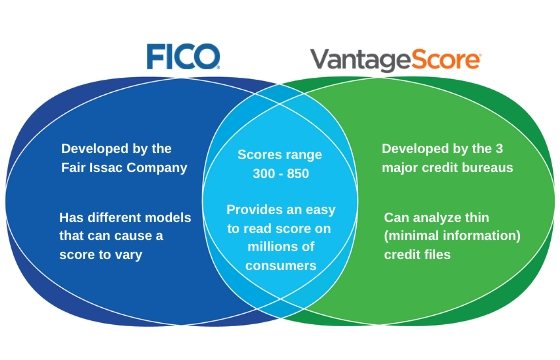

VantageScore 30 is a credit score that was designed by the three credit bureaus as an alternative to other scores such as FICO.

Vantagescore vs fico score. There is no official method of converting a VantageScore to a FICO score. One major difference between VantageScore and FICO is that the former uses trended data to calculate your credit score. News FICO scores are used by 90 percent of top lenders.

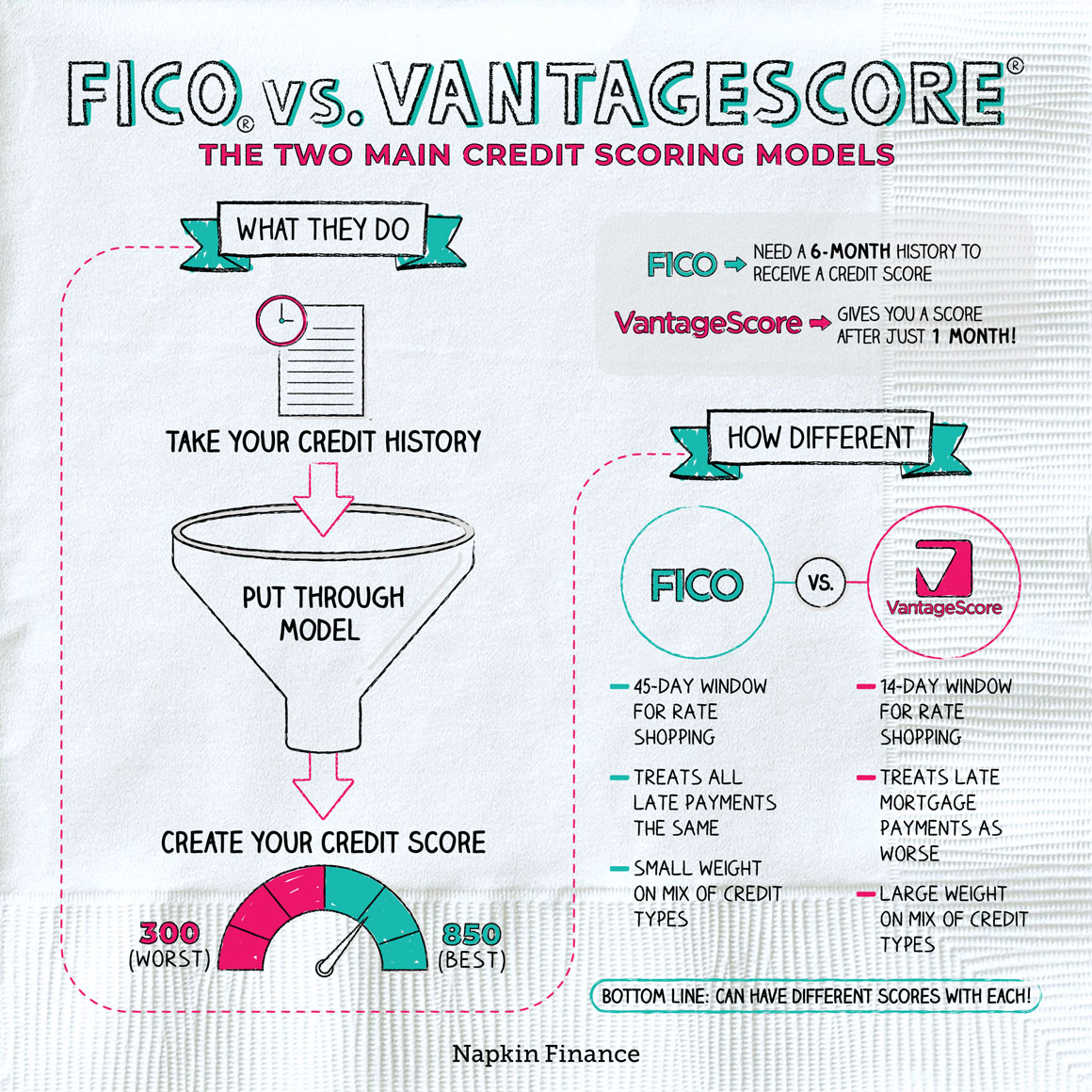

Many are unaware that recent changes can affect your score. FICO Counts multiple inquiries for rate-shopping for a mortgage auto loan or student loan as one inquiry within a 45-day period. FICO scores have been in use for a longer period of time and consequently are most widely used by lenders to make lending decisions.

You may come across either brand of credit score when you apply for financing like a credit card or a loan. FICO Score The primary difference between VantageScores and FICO scores is what they are used for. Touted as a consumer-friendlier scoring model more than 2200 financial institutions used more than 6 billion VantageScore credit scores from July 2016 to June 2017 according to research firm Oliver Wyman.

Lets look at the key factors that these models use to. Like a FICO score a VantageScore is a credit scoring model that tells lenders and creditors how likely you are to fall at least 90 days behind on a bill within the next 24 months. VantageScore and FICO criteria VantageScore and FICO credit-scoring models use data obtained from consumer credit reports to generate credit scores.

The first versions of VantageScore 10 later 20 initially ranged between 500 990 which made the conversion from VantageScore to FICO almost impossible. There are many documented differences between the two scores. VantageScore vs FICO Score Range.

We recommend Credit Sesame. The current VantageScore 30 was introduced in 2013 when they adjusted their scoring system to match FICOs range of 300 - 850 for credit scores. While FICO used a credit range of 300 to 850 VantageScore chose 501 to 990.

While both scoring models have the same scoring range and goal to determine a borrowers creditworthiness to help lenders decide whether or not to extend credit to an individual they do have different scoring methods. FICO score rages between 300 850. FICO scoring was invented by the Fair Issac Corporation to create an easy-to-understand way of rating the likelihood that an individual would pay bills on time.

But the VantageScore credit score even with less name recognition among consumers is giving FICO serious competition. Because each scoring uses different criteria and methods of pulling data its nearly impossible to convert. FICO and VantageScore are two generic credit score models that are used across the credit reporting industry.

But the data may affect scores differently depending on which model is being used. In general a FICO score of 700 or above provides easy credit access and good to excellent interest rates. FICO While converting a score between VantageScore and FICO used to be somewhat complicated with VantageScores older versions 10 and 20 ranging from 501990 the latest versions 30 and 40 use the same 300850 range as FICO scores.

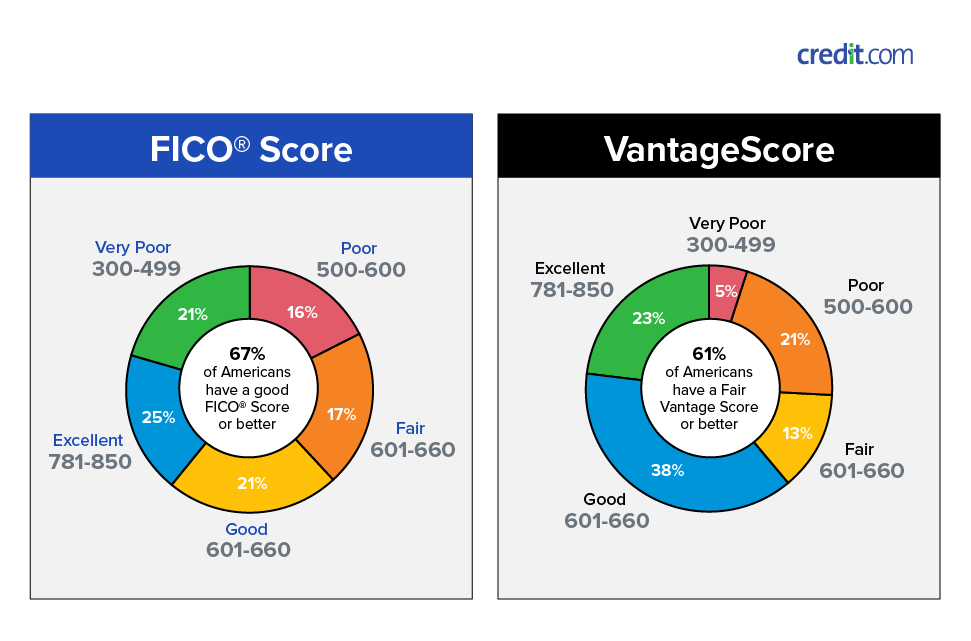

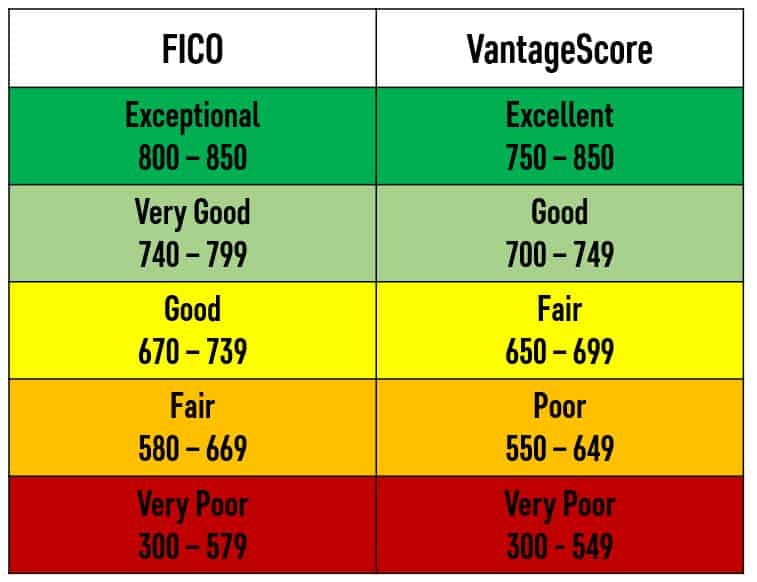

Both the FICO Score and VantageScore use a credit range of 300 to 850 with a higher number indicating greater creditworthiness. According to VantageScore this credit score model is used by more than 2500 lenders and 20 of the top 25 financial institutions for various purposes. FICOs credit scores those developed by the Fair Isaac Corporation and VantageScore credit scores developed by the credit reporting agencies are both commonly used.

VantageScore Counts multiple inquiries by utility companies or for a mortgage or auto loan as one inquiry within a 14-day period. So in 2013 the 3 credit bureaus launched the VantageScore 30 that adopted the 300-850 range used by FICO. Initially the biggest difference between VantageScore and FICO Score was the scoring range itself.

This means that while FICO takes a snapshot of your credit situation at the time of the inquiry VantageScore looks at more of your data over time to identify patterns. FICO Scores range from 350 to 850 and have the following meanings. Credit score ranges for VantageScore vs.

FICO is to credit scores what Kleenex is to tissues.

What Is A Good Credit Score Bestmortgagereports Com

What Is A Good Credit Score Bestmortgagereports Com

What The Difference Between Fico Credit Score And Vantagescore Quora

What Is The Difference Between A Fico Score And A Vantage Score Kc Credit Services

Vantagescore Vs Fico Score 4front Credit Union

Vantagescore Vs Fico Score 4front Credit Union

Difference Between Fico Vs Vantage Score Napkin Finance

Difference Between Fico Vs Vantage Score Napkin Finance

What Is The Most Accurate Credit Score Site Credit Scores And More

What Is The Most Accurate Credit Score Site Credit Scores And More

Vantage Score Vs Fico Credit Scores Range

Vantage Score Vs Fico Credit Scores Range

The Best Credit Score For The Multifamily Housing Industry

The Best Credit Score For The Multifamily Housing Industry

How To Get A Free Fico Credit Score From All 3 Credit Bureaus

How To Get A Free Fico Credit Score From All 3 Credit Bureaus

What Is A Vantagescore Nerdwallet

What Is A Vantagescore Nerdwallet

Fico Vs Vantage Score Credit World

Fico Vs Vantage Score Credit World

What Is A Good Credit Score Credit Com

What Is A Good Credit Score Credit Com

What Is A Good Credit Score Experian

What Is A Good Credit Score Experian

How High Can Your Credit Score Get Us Credit Advocate

How High Can Your Credit Score Get Us Credit Advocate

Comments

Post a Comment