Roth Ira Phase Out 2020

7 You are able to make contributions to your 2021 Roth IRA until April 15 2022. The same limit was for the year 2019.

Retirement Contribution Limits For 2020 Retirement News

Retirement Contribution Limits For 2020 Retirement News

The IRS extended the tax filing deadline for 2020 tax returns.

Roth ira phase out 2020. You are in the 24 or 32 tax bracket. In 2020 the phase-out range for single filers in 2020 is between 124000 139000 and for married couples filing jointly 196000 206000. But for Roth IRA there is an additional contribution limit that is based on how much income you have in the year of deposit.

If you are saving for retirement. Your filing status is married filing jointly or qualifying widower and your modified AGI is at least 196000. A full list of phase-out ranges for Traditional and Roth IRAs is included in STRATAs IRA Annual Limits.

You expect your 2020 taxable income to be lower than your 2019 taxable income. In 2021 these numbers were increased to 105000 125000 and 66000 76000 respectively What if after all the annual numbers are tallied your income falls within one of these phaseout ranges. The passage of the CARES Coronavirus Aid Relief and Economic Security Act in March 2020 allows for the withdrawal of up to 100000 from Roth or traditional IRAs without having to pay the 10.

If you are saving for retirement using the Roth IRA then you will. The deadline was moved from April 15 to May 17 2021. Whether or not you can make the maximum Roth IRA contribution for 2020 6000 annually or 7000 if youre age 50 or older depends on your tax filing status and your modified adjusted gross income MAGI.

If you earn between 125000 and 140000 124000 to 139000 you can contribute. For single and head of household taxpayers the phase-out range is 124000 to 139000. Individuals who are not eligible for Roth Contributions due to income limitations are generally still eligible to convert dollars from Traditional retirement.

Its important to note that conversions from other retirement accounts have no impact on your 2020 contribution limit but may increase your total Modified Adjusted Gross Income MAGI and therefore trigger a phaseout of your Roth IRA contribution amount. The income phase-out range for contributions to a Roth IRA vary. If you meet one or more of these criteria consider a Roth conversion in 2020.

6 The IRS extended the deadline for making 2020 contributions to your Roth IRA to May 17 as well. The 2020 limit for contributions to Roth IRA is 6000 or 7000 if youre aged 50 or older. Your contribution can be reduced or phased out as your MAGI approaches the upper limits of the applicable phase-out ranges listed below.

For 2020 and 2021 the annual contribution limit is set at 6000 per year or 7000 if youre age 50 or older. You are over age 70½ or turned 72 in 2020 and do not have to take your required minimum distribution RMD in 2020. By Megan Russell on April 24 2020 website builders The Roth IRA contribution phaseout range is currently a 10000 range.

Your IRA balance is over 500000. IRA Contribution Deadlines for 2020 and 2021 Make your 2020 IRA contribution soon time is of the essence For 2020 investors can make an IRA contribution anytime between January 1. 如何计算Roth IRA Phase Out以夫妻共同报税为例如果家庭收入超过196000可以存入Roth IRA的金额就开始递减超过206000.

9 lignes Find out if your modified Adjusted Gross Income AGI affects your Roth IRA contributions. For 2020 your Roth IRA contribution limit is reduced phased out in the following situations. Amount of Roth IRA Contributions That You Can Make for 2020.

Contributions to a Roth IRA will always be made with after-tax dollars but not everyone is able to participate. The income phase-out range for taxpayers making contributions to a Roth IRA is 125000 to 140000 for singles and heads of household. For married filing joint couples the range is 196000 to 206000.

For 2020 the phaseouts for IRA deductibility were 104000 to 124000 for marriedfiling joint and 65000 to 75000 for single filers. Today were talking about the new Roth IRa max income limits and phase out ranges for 2020. Those thresholds are up.

Many Ira And Retirement Plan Limits Will Increase For 2020 Ascensus

Many Ira And Retirement Plan Limits Will Increase For 2020 Ascensus

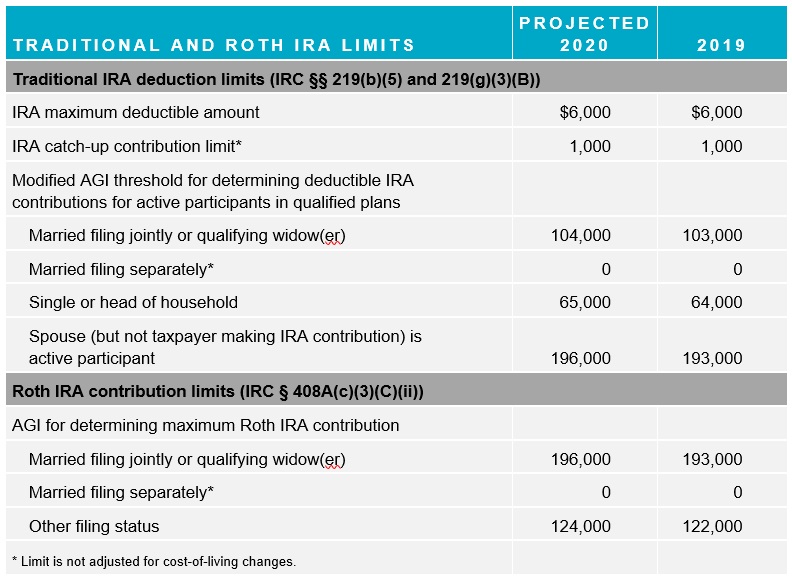

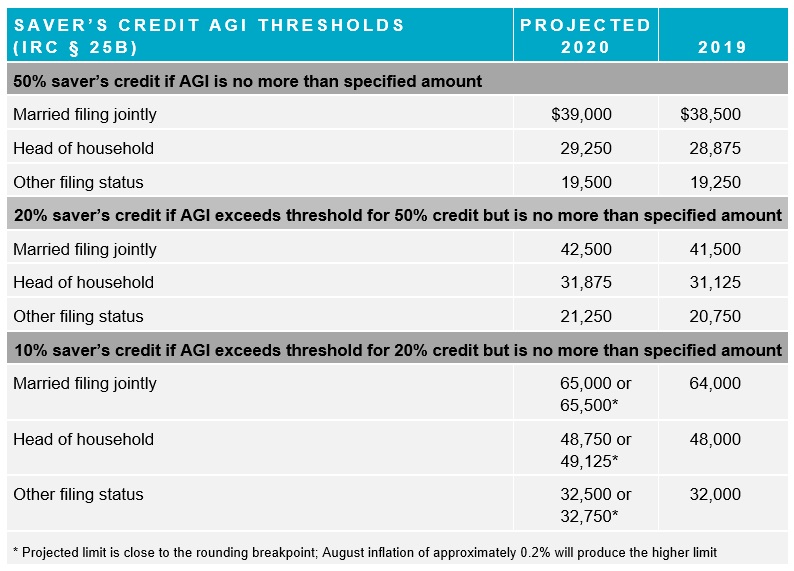

Mercer Projects 2020 Ira And Saver S Credit Limits Mercer

Mercer Projects 2020 Ira And Saver S Credit Limits Mercer

Roth Ira Contribution Limits Medicare Life Health 2019 2020 Rules Roth Ira Contributions Roth Ira Ira

Roth Ira Contribution Limits Medicare Life Health 2019 2020 Rules Roth Ira Contributions Roth Ira Ira

Maddox Thomson Associates 2020 Contribution Limits For Iras And Retirement Plans

Maddox Thomson Associates 2020 Contribution Limits For Iras And Retirement Plans

Why Most Pharmacists Should Do A Backdoor Roth Ira

Why Most Pharmacists Should Do A Backdoor Roth Ira

Historical Roth Ira Contribution Limits Since The Beginning

Historical Roth Ira Contribution Limits Since The Beginning

Many Ira And Retirement Plan Limits Will Increase For 2020 Ascensus

Many Ira And Retirement Plan Limits Will Increase For 2020 Ascensus

Ira Endeavor Limits Championing 2020 Plus 2020 2020 Maximum Roth Ira Contribution Over 50

Ira Endeavor Limits Championing 2020 Plus 2020 2020 Maximum Roth Ira Contribution Over 50

Mercer Projects 2020 Ira And Saver S Credit Limits Mercer

Mercer Projects 2020 Ira And Saver S Credit Limits Mercer

The 2020 Irs And Social Security Changes You Need To Know For Retirement Great Waters Financial

The 2020 Irs And Social Security Changes You Need To Know For Retirement Great Waters Financial

The Maximum 401 K Contribution Limit For 2020 Goes Up By 500

The Maximum 401 K Contribution Limit For 2020 Goes Up By 500

Your 2020 Annual Contribution Limits Midatlantic Ira

Your 2020 Annual Contribution Limits Midatlantic Ira

2019 Ira Contribution Limits Unchanged For 2020 401k And Hsa Caps Rise Investor S Business Daily

2019 Ira Contribution Limits Unchanged For 2020 401k And Hsa Caps Rise Investor S Business Daily

2020 Roth Ira Contribution And Income Limits Your Go To Guide

2020 Roth Ira Contribution And Income Limits Your Go To Guide

Comments

Post a Comment