Should I Pay More On My Mortgage

However there is a process to most efficiently achieve this. Each month that a mortgage payment is made the portion dedicated your principal increases and the portion dedicated to interest decreases.

Should You Make Extra Mortgage Payments Compare Pros Cons

Should You Make Extra Mortgage Payments Compare Pros Cons

Deciding whether to pay off more of your mortgage or save more into a pension is a difficult one to answer as both options are good financial practices.

Should i pay more on my mortgage. The opposite is also true. Ways to prepay your mortgage Pay more every month. Sometimes it may just make more sense to use your refinancing dollars to pay down your principal balance.

If the homeowner refinances their mortgage and uses the amount they save on monthly payments plus the 24000 additional income to pay it down more aggressively and. It comes from paying down your outstanding loan balance with. Some mortgage lenders charge a penalty if you pay more than your usual monthly amount so you need to check before you start making overpayments.

Pay mortgage more aggressively. Even if you can only commit to 25 or 50 it can save you thousands over the course of the loan. Though your payments will be a bit higher your overall savings will be greater.

However there are pros and cons to each and you need to take other factors into consideration when deciding which. If you pay your mortgage bill online you might want to find out whether the lender will let you include a note specifying how additional payments should be used. Looking at my peers it seems that the fiduciary-fee-only advisors say to pay it off whereas the national brokerage firms gamble with their clients best interests.

The answer to this almost always is that you should overpay if you have the choice. The average return from the stock market is about 7. For a FREE Mortgage Review to find out How We Can Help You.

The first option is to analyze your budget and see if you can afford to increase the amount you pay on your mortgage each month. The more you pay. Check out these tips for paying off a mortgage faster.

Pay 948 a month188 moreand youll pay off the mortgage in 20 years and. Anzeige Mortgages and Remortgages for Adverse Credit Clients Contact us Today. It could be one extra mortgage payment a year two extra mortgage payments a year or an extra payment every few months.

Should I overpay my mortgage each month or ask my lender to officially reduce the term. The benefit of paying additional principal on a mortgage isnt just in reducing the monthly interest expense a tiny bit at a time. Mortgage lenders are in business to make money and one of the ways they do that is by charging you interest on your loan.

Consider applying any extra funds at the end of the month toward your loan balance. The higher the interest rate attached to your mortgage the more youll be paying towards the interest portion of your mortgage payments. Now that you understand the power of paying extra principal on your loan whats your plan of action.

A lot of people dont do either and end up spending more on their lifestyle such as more holidays nights out or luxuries. For a FREE Mortgage Review to find out How We Can Help You. Consider that the average interest rate on a mortgage is about 5.

For instance you could use the 5400. Decreasing the term sounds sensible and does almost exactly the same job that overpaying does both mean you pay more each month you pay less interest and your mortgage is paid off sooner. Even paying an extra 50 or 100 a month allows you to pay off your mortgage faster.

How to pay off a mortgage faster. At Wiser Wealth Management we believe that your house should be paid for by retirement to help free up cash flows. Make more frequent payments.

Anzeige Mortgages and Remortgages for Adverse Credit Clients Contact us Today. Youll pay 123609 in interest over the life of the loan assuming you make only the minimum payment of 760 each month. Not Asking If Theres a Prepayment Penalty.

Turns out having a shorter mortgage or paying more than the minimum is one of the riskiest things you can do for your finances. You will almost certainly save more in the long run by paying these high-interest debts before making extra payments on a mortgage. Another idea is to refinance to a 15-year mortgage.

Make an extra payment each year. If the penalties outweigh what you will save it will be more cost effective to put your extra cash into a savings account instead.

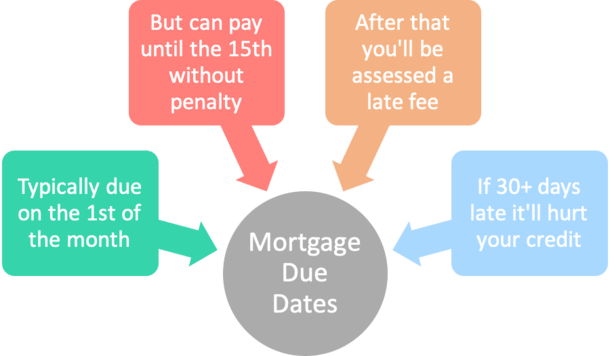

Mortgage Due Dates 101 The Truth About Mortgage

Mortgage Due Dates 101 The Truth About Mortgage

How To Pay Off Your Mortgage In 5 Years Mintlife Blog

How To Pay Off Your Mortgage In 5 Years Mintlife Blog

Should You Pay Off Your Mortgage Early

Should You Pay Off Your Mortgage Early

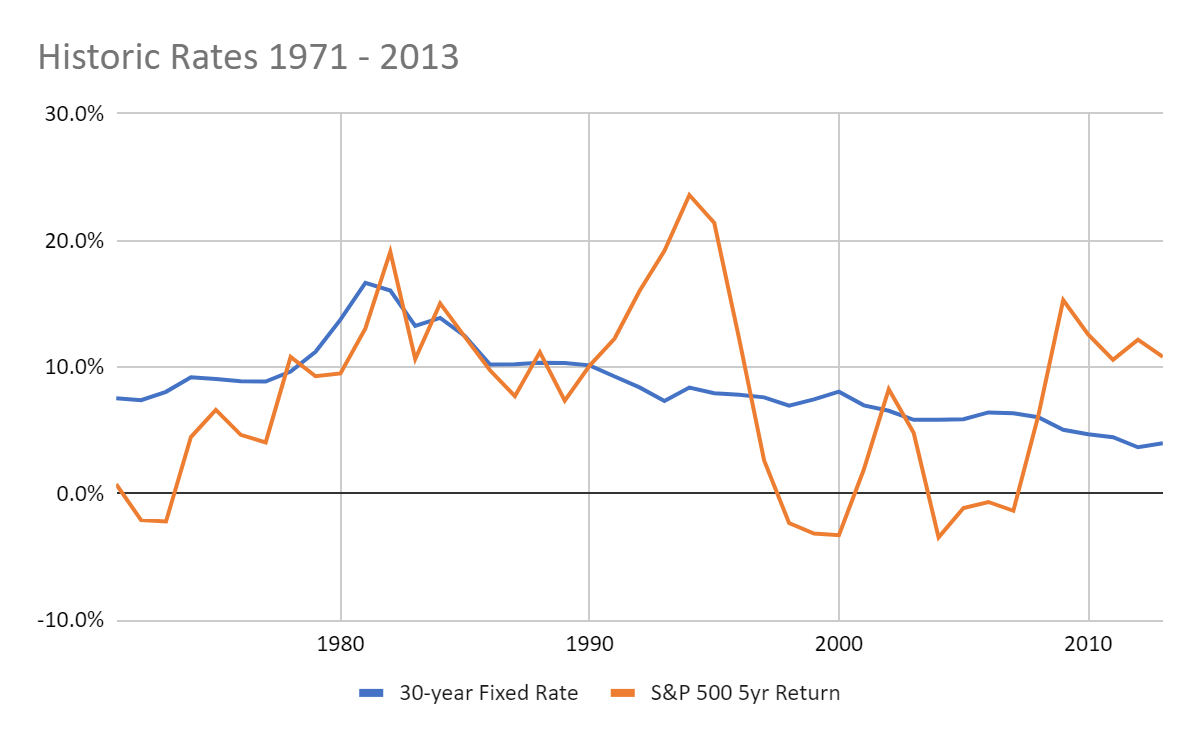

Should I Pay Off My Mortgage Or Invest In Shares The New Daily Centaur Financial Services

Should I Pay Off My Mortgage Or Invest In Shares The New Daily Centaur Financial Services

How Much Should I Pay On My Mortgage Mutilate The Mortgage

How Do I Make Extra Principal Payments On My Loans

How Do I Make Extra Principal Payments On My Loans

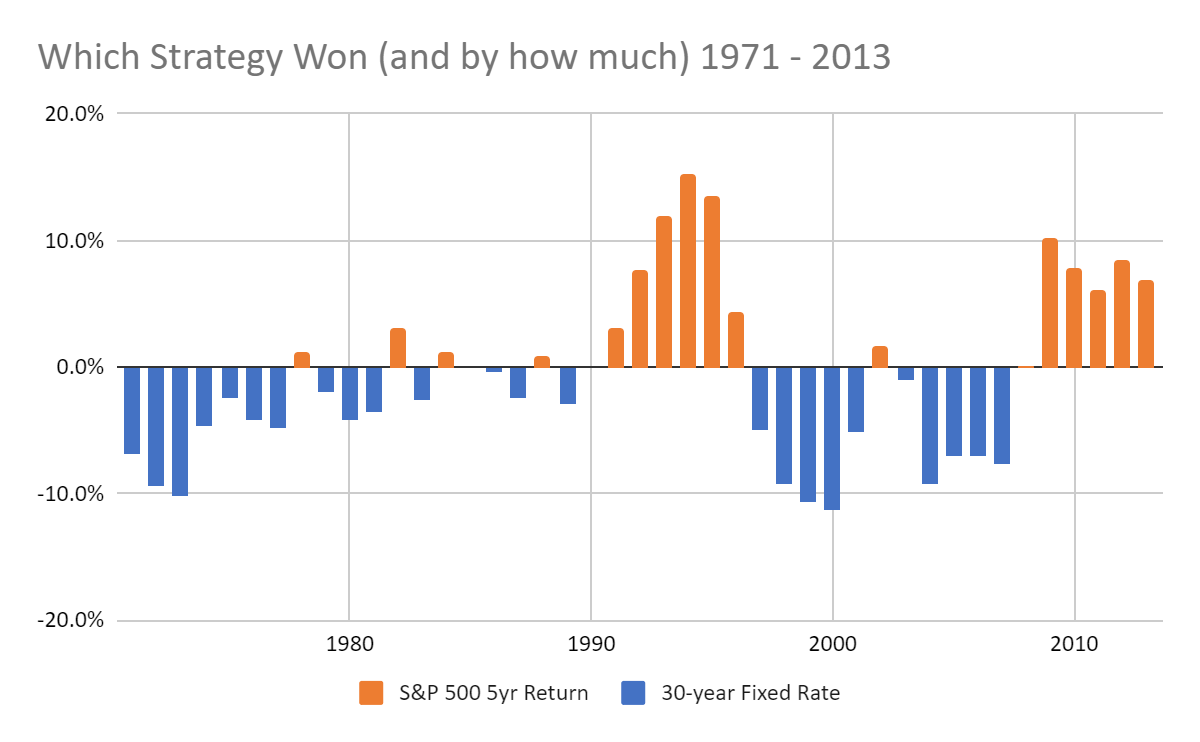

Should I Pay Off My Mortgage Or Invest The Money Us Mortgage Of Florida

Should I Pay Off My Mortgage Or Invest The Money Us Mortgage Of Florida

How Much House Can You Afford Money Under 30

How Much House Can You Afford Money Under 30

/choosing-a-down-payment-315602-Final-21f6f43a49084466afd65a24f1d288b9.png) Down Payments How They Work How Much To Pay

Down Payments How They Work How Much To Pay

Should I Pay Off My Mortgage Or Invest The Money Us Mortgage Of Florida

Should I Pay Off My Mortgage Or Invest The Money Us Mortgage Of Florida

Is It Better To Pay Off Your Mortgage Or Save For Retirement Loanry

Is It Better To Pay Off Your Mortgage Or Save For Retirement Loanry

Payoff Mortgage Early Or Invest The Complete Guide Mortgage Payoff Pay Off Mortgage Early Mortgage Tips

Payoff Mortgage Early Or Invest The Complete Guide Mortgage Payoff Pay Off Mortgage Early Mortgage Tips

Should I Pay A Lump Sum Into My Pension Or Into My Mortgage

Should I Pay A Lump Sum Into My Pension Or Into My Mortgage

Comments

Post a Comment