Sector Rotation Etf

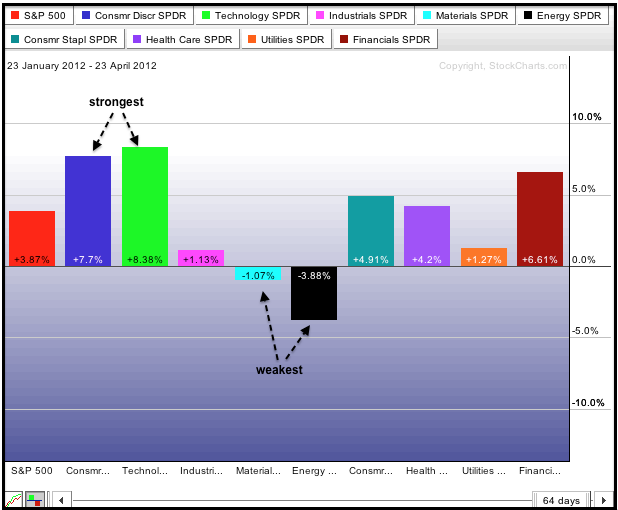

ETFs provide easy access to markets that were previously harder to invest in such as commodities or a diversified basket of stocks from one stock sector. ETF Sector Portfolio The 5 Strongest ETFs 20 in each were bought on Jan 1 2020 and were sold on Mar 31 2020.

How To Beat The Market With Sector Rotation Seeking Alpha

How To Beat The Market With Sector Rotation Seeking Alpha

Oder Sie gewichten dauerhaft die Branchen mit den besten langfristigen Aussichten stärker in Ihrem Portfolio.

Sector rotation etf. The investment approach combines quantitative and qualitative analysis and dynamically adjusts active risk budgets relative to. Sektorrotation auf einem Blick. The Guggenheim Sector Rotation ETF NYSE.

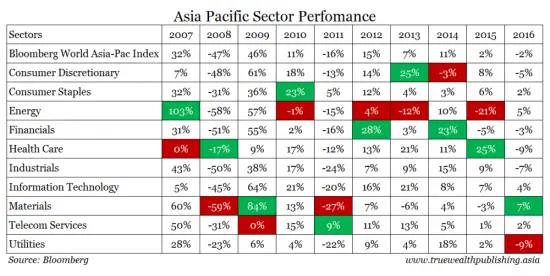

Ein Blick in die Statistik zeigt dass diese Produkte auf reges Interesse stoßen. Exchange-traded funds ETFs that concentrate on specific industry sectors offer investors a straightforward way to participate in the rotation of an industry sector. AMUNDI EUROPEAN SECTOR ROTATION FUND P CD FONDS Fonds WKN A2N4Q2 ISIN FR0013356094 Aktuelle Kursdaten Nachrichten Charts und Performance.

This was the beginning of the ATGL ETF Rotation portfolio 50000. On April 1 2020 only 2 Funds were Above the Green Line 250-day ema and were bought. Sector rotation ETFs have had a checked past.

The SPDR SSGA US Sector Rotation ETF seeks to provide capital appreciation by tactically allocating among the GICS-defined sectors of the S. These are rules based strategies which combine elements of investing and trading to lower volatility and improve returns. Wenn Sie zum Beispiel davon ausgehen dass.

After conducting our research we present our members with the top 3 ranked sectors based upon our criteria. Trailing total returns including dividends relative strength and our own technical and fundamental analysis. TheMain Sector Rotation ETF SECT seeks to achieve its objective through dynamic sector rotation.

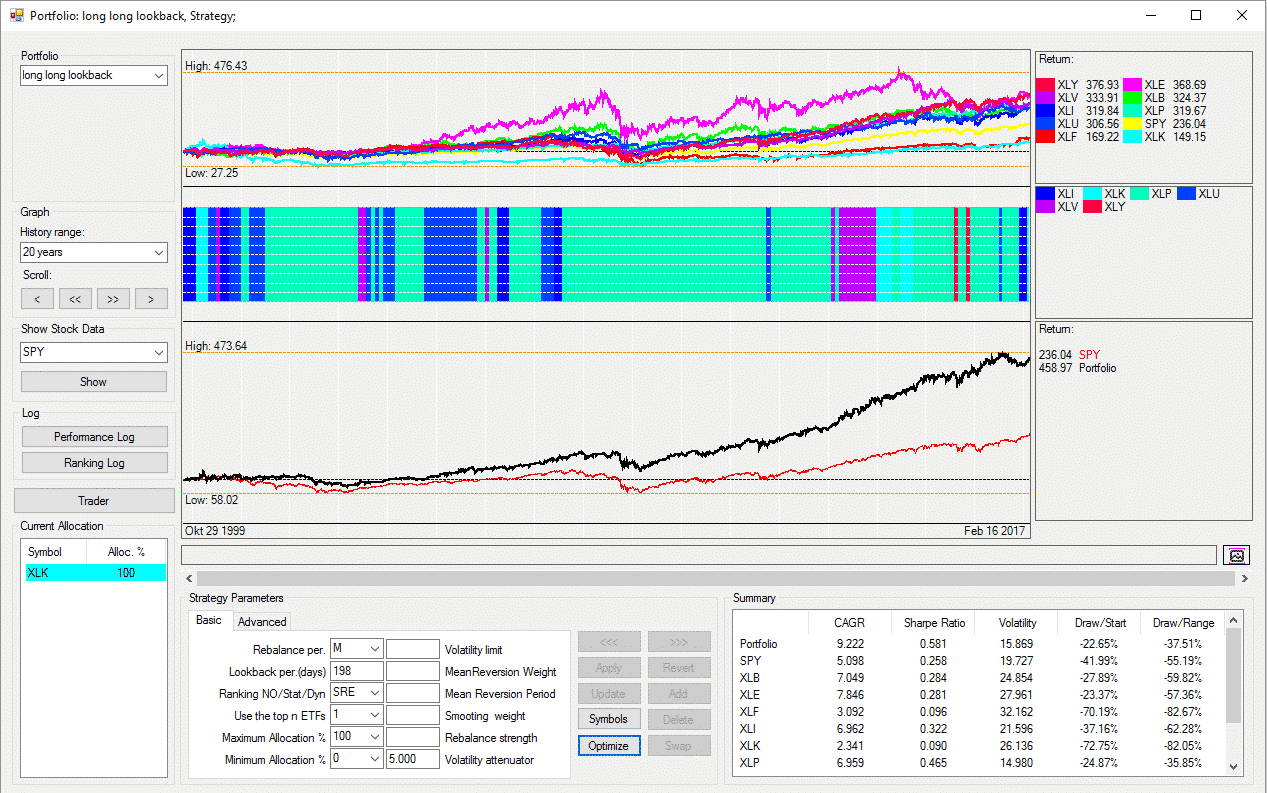

Which ETFs should you use. One of the most sensible is an ETF rotation strategy which periodically rotates money out of ETFs where momentum has slowed into ETFs showing strong momentum or offer better value. So the sector rotation model performed about 4x better than the SP500.

Umsetzen lässt sich die Sektorstrategie am einfachsten mit Hilfe von Exchange Traded Funds ETFs. ETF Launch Press Release PDF FUND PRICES. Sector selection is optimized by carefully reviewing the sector industry and sub-industries in the funds portfolio and allocating to sectors which appear.

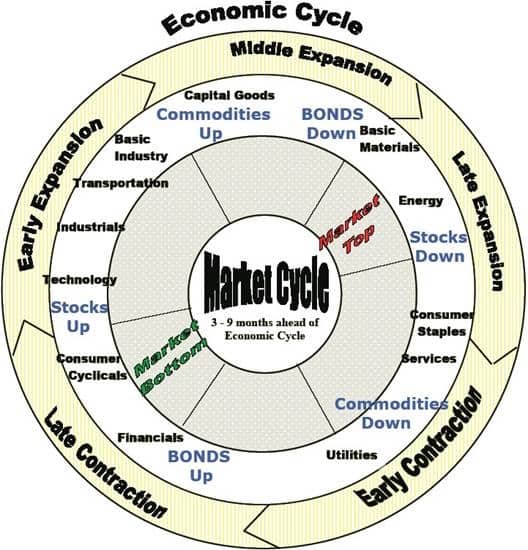

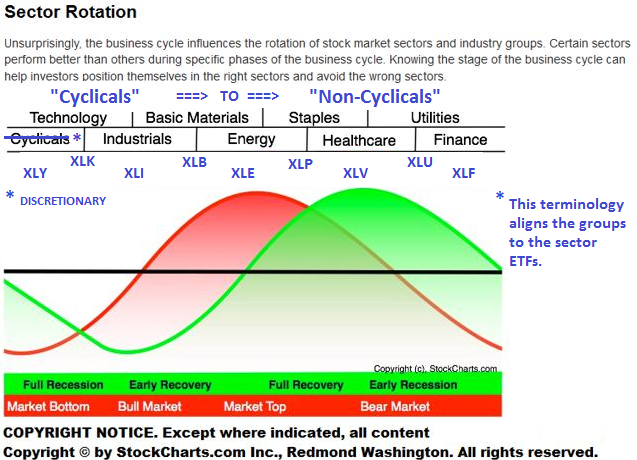

Außerdem können Sie mit Branchen-ETFs eine sogenannte Sektor-Rotations-Strategie umsetzen. Our members have full online access to our Sector ETF model. The stock market changes all the time as money rotates into investments representing different sectors of the economy.

Sectors and industries and another based on. ETFnext is a research tool that makes it easier to follow the sector rotation of the stock market. This is an actively managed fund that seeks to outperform the SP 500 in rising markets while limiting losses during periods of decline.

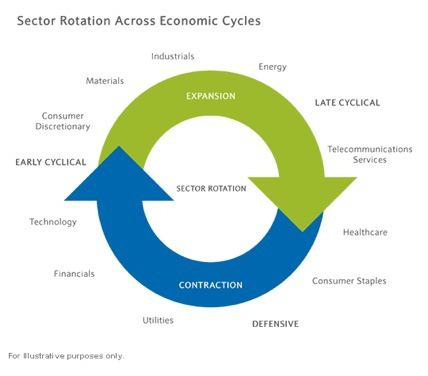

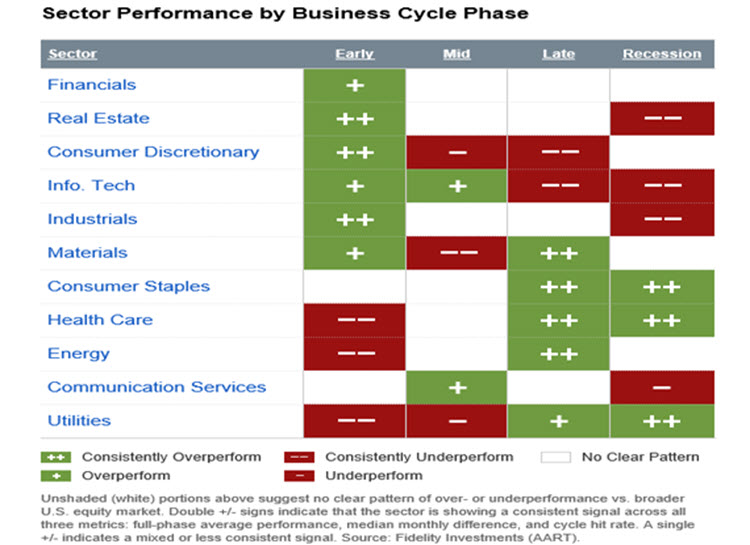

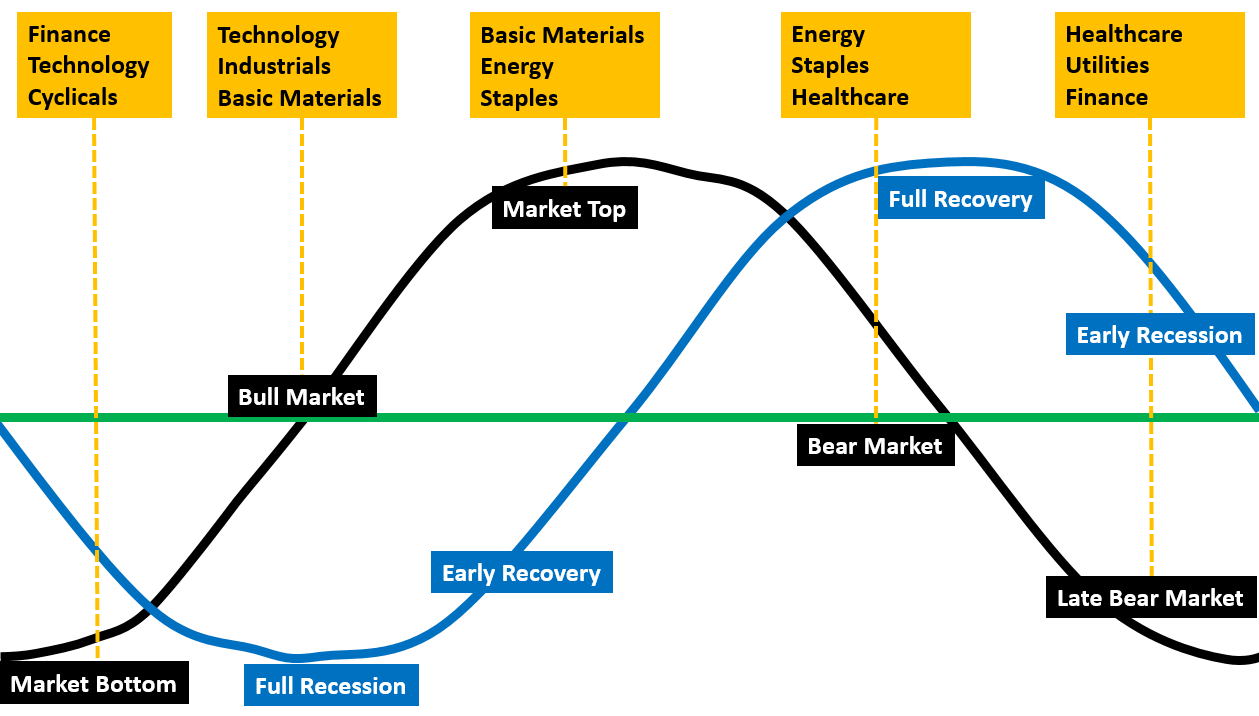

Each quarter we track and analyze all 11 SP 500 sectors based upon. Dabei werden die Branchen höher gewichtet die in der nächsten Phase des Konjunkturzyklus am wahrscheinlichsten profitieren. Anleger steht hier ein breites Spektrum an globalen und regionalen Branchenindizes zur Verfügung.

Die in Sektor-ETFs investierten Gelder in Mio. After selecting up to a dozen fundsstocks for your. The MSCI ESG Fund Rating measures the resiliency of.

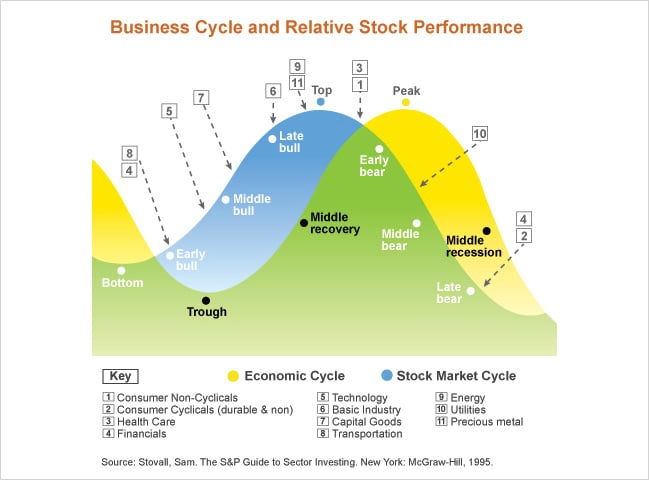

SECT - Main Sector Rotation ETF. How does the Sector Rotation ETF Strategy work. Sector rotation strategies attempt to determine which segments of the global economy are likely to be the strongest investing in ETFs related to those specific markets.

Sector rotation is a strategy used by investors whereby they hold an overweight position in strong sectors and underweight positions in weaker sectors. Exchange-traded funds ETFs that concentrate. The result is a meta sector ETF rotation strategy which performed well since 2000 in the backtests.

SECT MSCI ESG Analytics Insight Main Sector Rotation ETF has an MSCI ESG Fund Rating of A based on a score of 578 out of 10. Research has shown that sector rotation strategies can produce superior returns. Example Sector Rotation Strategies Trend-Following Investment Strategies to Use or Customize Example Strategies Overview A Strategy is simply a specific group of mutual funds ETFs or stocks chosen to manage an investment account.

The fund seeks to achieve its objective through dynamic sector rotation. XRO based on the proprietary Zacks Sector Rotation Index launched in. For example the Strategy may focus on country funds sector funds conservative bonds or individual stocks.

Sector rotation is a strategy used by investors whereby they hold an overweight position in strong sectors and underweight positions in weaker sectors. Sector selection is optimized by carefully reviewing the sector industry and sub-industries in the funds portfolio and allocating to sectors which appear undervalued and poised to respond favorably to financial market catalysts. The Sector rotation strategy produced an average yearly profit of 128 SPY 51 and a Sharpe ratio of 116 SPY 025.

Maximum drawdown was only 17 SPY ETF 55. The Global Rotation strategy basically uses trend-following and momentum to choose between two portfolios - one based on different US.

Sector Rotation Strategies Fidelity

Sector Rotation Strategies Fidelity

Sector Rotation Asymmetry Observations

Sector Rotation Asymmetry Observations

The Mother Of All Sector Rotation Strategies Lucena Research

The Mother Of All Sector Rotation Strategies Lucena Research

A Winning Sector Rotation Strategy New Trader U

A Winning Sector Rotation Strategy New Trader U

Etf Sector Rotation Strategy Above The Green Line

Etf Sector Rotation Strategy Above The Green Line

How To Profit From Stock Market Sector Rotation Above The Green Line

How To Profit From Stock Market Sector Rotation Above The Green Line

The Spdr Etf Sector Rotation Strategy Model Logical Invest

The Spdr Etf Sector Rotation Strategy Model Logical Invest

Understanding Stock Sector Rotation Select Sector Etfs

The Spdr Etf Sector Rotation Strategy Model Logical Invest

The Spdr Etf Sector Rotation Strategy Model Logical Invest

Understanding Stock Sector Rotation Select Sector Etfs

3 Sector Rotation Strategies For Etf Investors

3 Sector Rotation Strategies For Etf Investors

Sector Rotation Watch Earnings Seeking Alpha

Sector Rotation Watch Earnings Seeking Alpha

How To Beat The Market With Sector Rotation Seeking Alpha

How To Beat The Market With Sector Rotation Seeking Alpha

Myetf By I Vcap Islamic Exchange Traded Funds Sector Rotation

Myetf By I Vcap Islamic Exchange Traded Funds Sector Rotation

Comments

Post a Comment