Can You Write Off Medical Expenses

In this case you can now deduct 2100 in medical expenses from your tax return. At this time all unreimbursed medical expenses.

Are Medical Expenses Tax Deductible Turbotax Tax Tips Videos

Are Medical Expenses Tax Deductible Turbotax Tax Tips Videos

This includes either partners children or stepchildren who are 18 years old or younger and these expenses are listed on line 33099 of your tax return.

Can you write off medical expenses. For tax year 2020 the IRS permits you to deduct the portion of your medical expenses. Yes you can claim medical expenses on taxes. Tax laws change periodically and you should consult with a tax professional for the most up-to-date advice.

Virtually all medically necessary costs prescribed by a physician are tax deductible. The calculation is the same regardless of your adjusted gross income. 100 free fed state PLUS free expert review.

Yes you can claim medical expenses on taxes. Answers do not constitute written advice in response to a specific written request of the taxpayer within the meaning of section 6404 f of the Internal Revenue Code. What is the medical expense deduction.

Yes you can claim medical expenses on taxes. Medical expenses for the immediate family can be claimed by either you or your spouse. Can You Write Off Medical Expenses.

For simple tax returns only file fed and state taxes free plus get a. Are any pandemic-related qualified medical expenses not tax deductible. If you incur medical expenses that add up to more than 75 of your Adjusted Gross Income AGI for the 2020 tax year you can deduct those expenses on Schedule A.

In order to deduct your medical expenses they must add up to more than 3000 75 percent of 40000. 2 Along with direct medical expenses deductions allowed include the cost of insurance premiums long-term care insurance premiums and Medicare. If youre itemizing your expenses just write down your adjusted gross income enter 75 of this figure and the difference between your costs and the 75 you just wrote down.

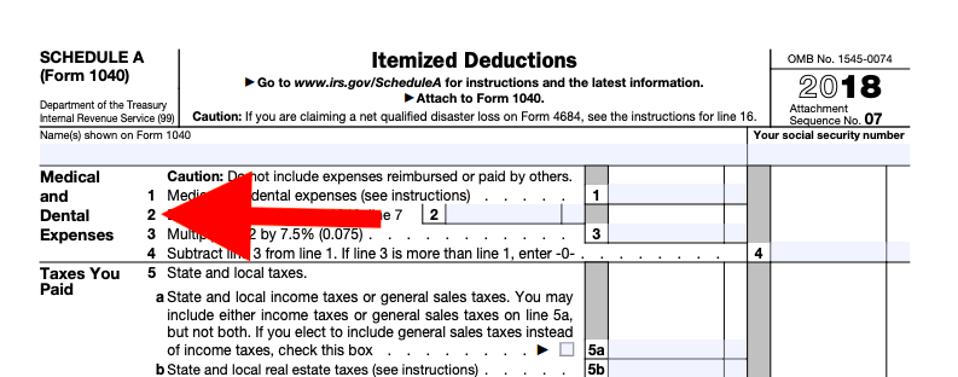

For tax returns filed in 2021 taxpayers can deduct qualified unreimbursed medical expenses that are more than 75 of. You can deduct the amount of your medical and dental expenses that exceed 75 of your adjusted gross income AGI. After 15 minutes of inactivity youll be forced to start over.

Other taxpayers can deduct the cost of health insurance as an itemized deduction only if their overall medical and dental expenses exceed 75 of their adjusted gross incomes in 2020. Can You Write Off Medical Expenses. You also cant deduct medical expenses paid in a different year.

But not everyone will. You may deduct only the amount of your total unreimbursed medical expenses that exceed 75 percent of your adjusted gross income the amount on Form 1040 or Form 1040-SR line 8b. If your qualifying medical expenses are more than 7500 subtract 7500 from your total expenses to learn the dollar amount you may be able to deduct on your federal tax return.

For example if your total qualifying expenses were 11000 you may be able to take a. If a medical practitioner certifies in writing that you were not able to travel alone to get medical services you can also claim the transportation and travel expenses of an attendant. You can deduct the medical expenses you paid that were incurred by you your spouse or someone who was your dependent at the time.

For tax year 2020 the IRS permits you to deduct the portion of your medical expenses that exceeds 75 of your adjusted gross income or AGI. Additionally if you pay for your medical expenses using money from a flexible spending account or health savings account those expenses arent deductible because the money in those accounts is already tax-advantaged. If you have travel expenses to get medical services and you also qualify for northern residents deductions line 25500 of your return you may be able to choose how to claim your expenses.

TurboTax can help you with determine how much if any of your medical expenses are deductible and will fill in all the right forms to claim the deduction. For example if your AGI is 50000 and your medical expenses total to 5000 you can deduct 1250 of. Lets say your adjusted gross income is 40000.

For tax year 2020 the IRS permits you to deduct the portion of your medical expenses that exceeds 75 of your adjusted gross income or AGI.

Repealing The Medical Expense Deduction Would Harm Some Middle Class Families Center For American Progress

Repealing The Medical Expense Deduction Would Harm Some Middle Class Families Center For American Progress

Medical Deduction Itemizing Threshold Permanently Dropped Back To 7 5 Of Agi Don T Mess With Taxes

Can I Deduct Medical Expenses I Paid For My Parent Agingcare Com

Can I Deduct Medical Expenses I Paid For My Parent Agingcare Com

Are Medical Expenses Tax Deductible Community Tax

Are Medical Expenses Tax Deductible Community Tax

How To Claim A Tax Deduction For Medical Expenses In 2021 Nerdwallet

How To Claim A Tax Deduction For Medical Expenses In 2021 Nerdwallet

Taxes From A To Z 2019 M Is For Medical Expenses

Taxes From A To Z 2019 M Is For Medical Expenses

What To Know About Deductible Medical Expenses E File Com

What To Know About Deductible Medical Expenses E File Com

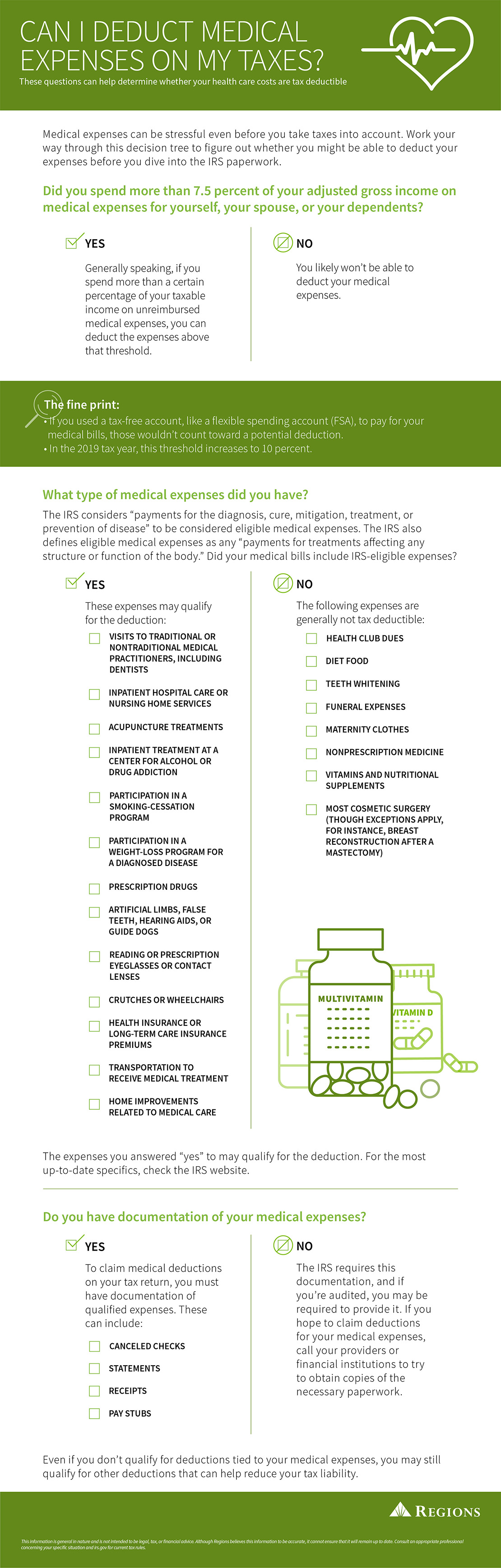

Can I Deduct Medical Expenses On My Taxes Regions

Can I Deduct Medical Expenses On My Taxes Regions

Turn Your Personal Medical Expenses Into 100 Corporate Expenses

Turn Your Personal Medical Expenses Into 100 Corporate Expenses

Can You Write Off Medical Expenses On Your Tax Return Oxygen Financial

Can You Write Off Medical Expenses On Your Tax Return Oxygen Financial

:max_bytes(150000):strip_icc()/GettyImages-88305470-56fb095d5f9b5829867a30b3.jpg) How To Write Off Medical Expenses As A Tax Deduction

How To Write Off Medical Expenses As A Tax Deduction

Can I Claim Medical Expenses On My Taxes H R Block

Can I Claim Medical Expenses On My Taxes H R Block

How To Claim A Tax Deduction For Medical Expenses Bankrate

How To Claim A Tax Deduction For Medical Expenses Bankrate

Publication 502 2020 Medical And Dental Expenses Internal Revenue Service

Publication 502 2020 Medical And Dental Expenses Internal Revenue Service

Comments

Post a Comment