401k Management Fees

What Are 401 k Management Fees. Custodial fees are charged by you guessed it the plans custodian.

What Are Industry Average Fees For A Fiduciary Grade 401 K Financial Advisor Sapling Wealth

What Are Industry Average Fees For A Fiduciary Grade 401 K Financial Advisor Sapling Wealth

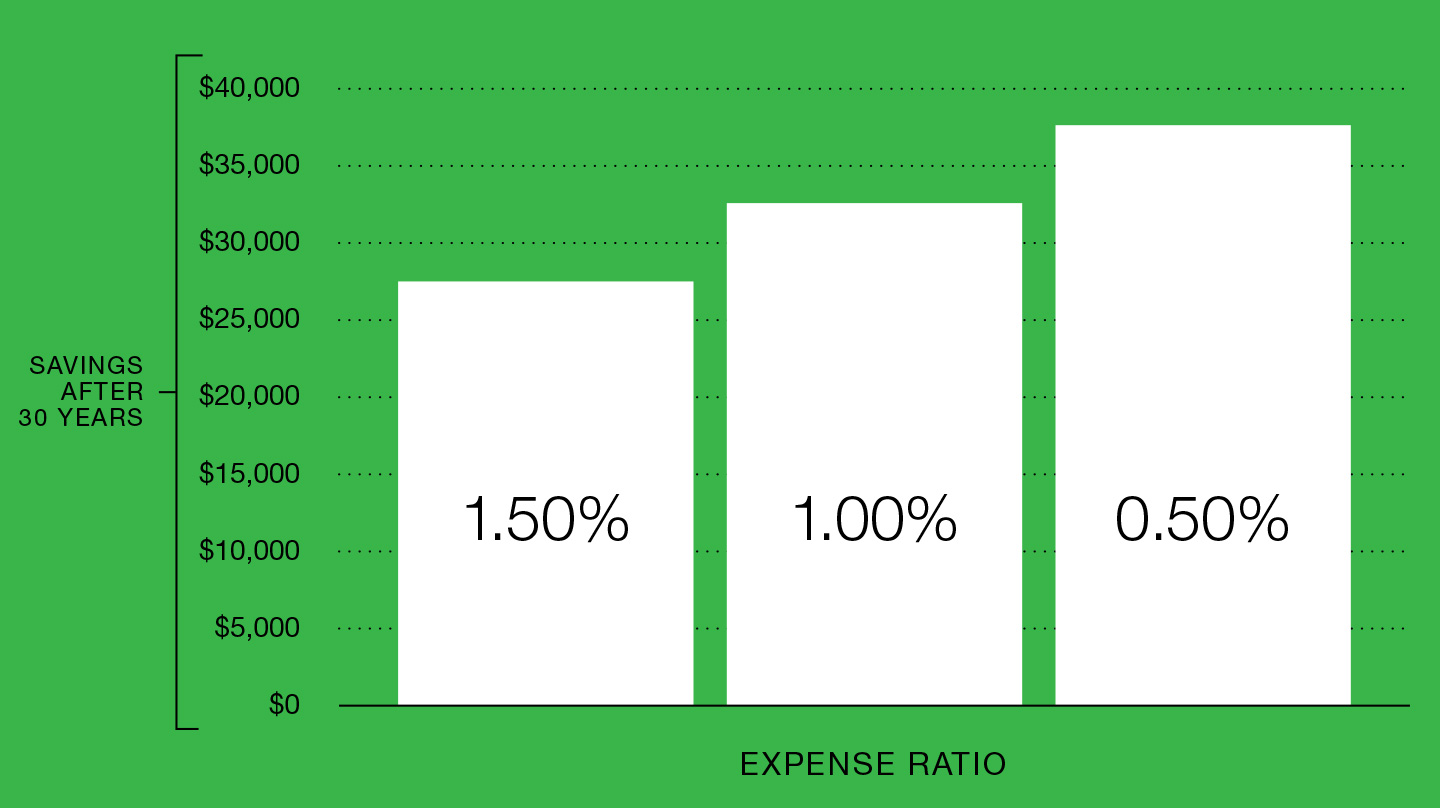

401 k plan fees can vary greatly depending on the size of your employers 401 k plan the number of participants and the plan provider.

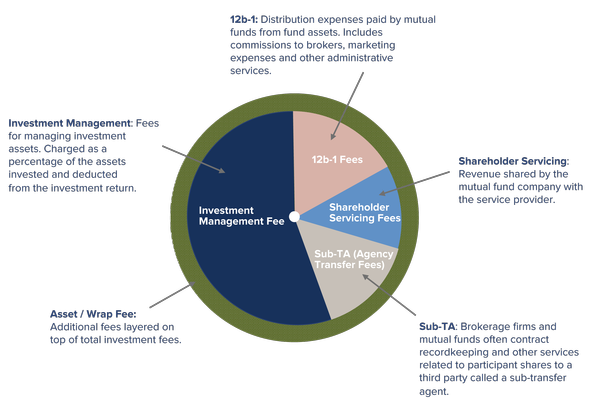

401k management fees. The Department of Labor divides 401 k fees into three categories. The total expense ratio can cover the administrative fees operating expenses recordkeeping fees management fees and marketing 12b1 fees as well as all other investment fees and expenses. The cost is even greater for high-income earners.

Management fees also known as. Investment fees are based on the individual funds or investments you have within the plan. Disbursement help free help.

The biggest factors in the cost of your 401 k are the size of your company and the plan it uses David Blanchett head of retirement research for Morningstars Investment Management. However this professional management comes at a price. Many 401k providers charge a fee for investment management servicesusually a percentage of the account balanceon top of fees already embedded in mutual funds.

Recordkeeper or Platform Fees. There are fees whether your money is in a. These costs are sometimes outlined.

Some of these 401 k fees are charged at a plan level for the management and administration of a plan while others are related to the investments made by employees within the plan. For 401k investors some of the key fees to be aware of in a 401k investment vehicle include management fees. Depending on the service provider and how much you have to invest a managed account can cost you 015 to 07 a year.

These figures are reflective of average 401k fees which CAP estimates to be approximately 1 of total plan assets. Anzeige Non Resident Alien from the US Retirement Withdrawal 401k US. Administrative fees are the hardest to locate and the least understood.

401k plan fees typically fall into three categories. Sometimes management fees may be used to cover administrative expenses. IRA 401K withdrawal Non Resident Alien 401K IRA retirement reduce tax International Tax.

According to an analysis by BrightScope large 401 k plans with 100 million or more in assets typically charge less than 1 in annual fees. These fees commonly disclosed in mutual fund prospectuses and annual reports cover the cost of managing the investments. The investment fee is likely the single largest fee you will pay.

Your recordkeeper is the entity that tracks the different sources of money in your. Investment Fees on a 401 k If you have money in a 401 k then you are paying investment fees. These are ongoing charges for managing the assets of the investment fund.

The level of. Investment advisory fees. Anzeige Non Resident Alien from the US Retirement Withdrawal 401k US.

Disbursement help free help. You should be able to calculate your 401K fees in just a few minutes. 401 k plan administrators have a lot on their plates.

Sometimes the fees paid in a 401 k are. Typically 401 k plans have three types of fees. If your plan.

Investment administrative and individual service fees. Administrative and investment fees. Another study found that 401k participants pay an average all-in fee of 222 of their assets but that there is a wide range between 02 and 5.

These third-party providers are. They are generally stated as a percentage of the amount of assets invested in the fund. Behind the scenes investment managers are managing your 401 k funds to help maximize potential gains.

IRA 401K withdrawal Non Resident Alien 401K IRA retirement reduce tax International Tax. There are actually two types of general fees you will need to calculate. Your 401 k expense ratio is the percentage of retirement fund assets that plan participants pay for their investments.

If you continue with your current fee structure and accept the 750 return your 100000 401 k plan will grow to 875495 after 30 years. Investment fees administrative fees and fiduciary and consulting fees. We dont charge these added investment fees.

One study found that large plans more than 100 million. The Differences Between 401k and 403b Plans.

Are 401 K Fees Eating Into Your Retirement Now Migh Ticker Tape

Are 401 K Fees Eating Into Your Retirement Now Migh Ticker Tape

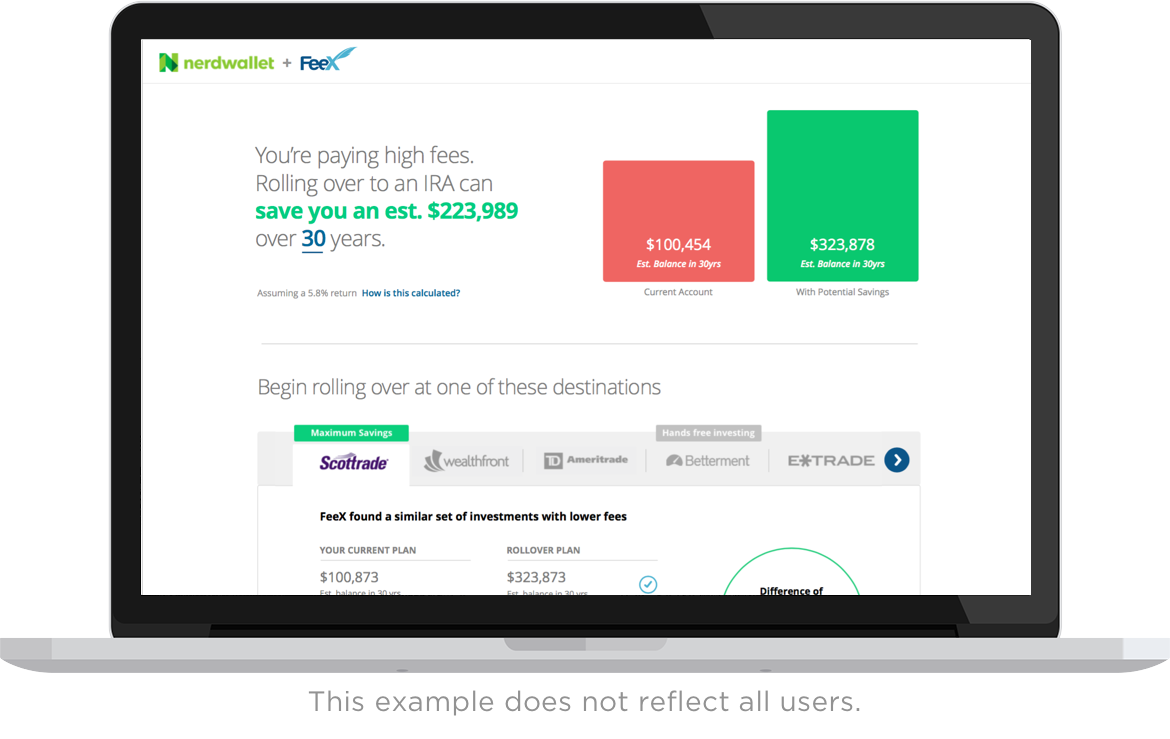

Analyze Your 401 K Fees Retire Richer Nerdwallet

Analyze Your 401 K Fees Retire Richer Nerdwallet

A Structured Approach To Understanding 401 K Fees And Disclosures Onebite

A Structured Approach To Understanding 401 K Fees And Disclosures Onebite

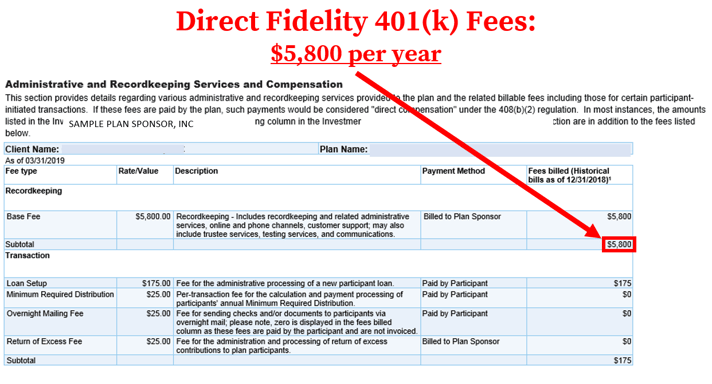

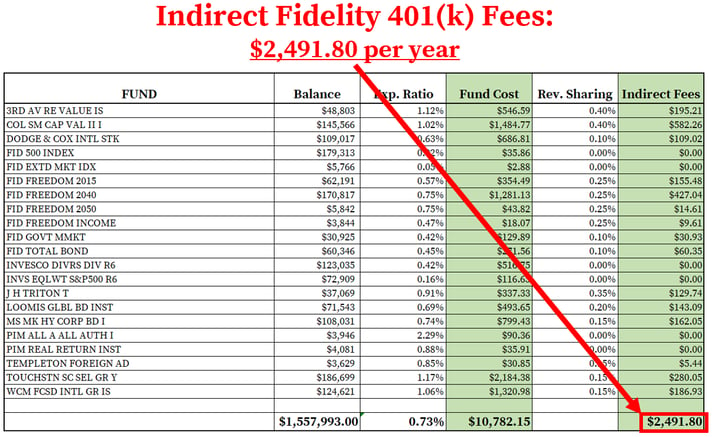

How To Find Calculate Fidelity 401 K Fees

How To Find Calculate Fidelity 401 K Fees

How To Find Calculate Fidelity 401 K Fees

How To Find Calculate Fidelity 401 K Fees

What You Need To Know About 401 K Fees Fisher 401k

What You Need To Know About 401 K Fees Fisher 401k

401 K Sponsors Focus On Benchmarking And Lowering Fees

401 K Sponsors Focus On Benchmarking And Lowering Fees

Fees Advance Capital Management 401k

Fees Advance Capital Management 401k

Infographic On 401k Plan Fees 401khelpcenter Com

Fee Analyzer Mutual Fund Fee Calculator Personal Capital

Fee Analyzer Mutual Fund Fee Calculator Personal Capital

Who Are The Best 401 K Providers For Your Small Business

Who Are The Best 401 K Providers For Your Small Business

Fees And Expenses Associated With Your Plan 401 K 403 B Fiduciary Advisors Inc

Fees And Expenses Associated With Your Plan 401 K 403 B Fiduciary Advisors Inc

What You Need To Know About Common Investment Fees Principal

What You Need To Know About Common Investment Fees Principal

404 A 5 Participant Fee Disclosures Rules Requirements

404 A 5 Participant Fee Disclosures Rules Requirements

Comments

Post a Comment